Solar Panel Scheme Registration

The government of Pakistan, in teamwork with the Bank of Punjab (BOP), has threw a Solar Panel Scheme Registration to make renewable energy more nearby for households and businesses. As electricity costs rise and power lacks remain a challenge, this creativity aims to provide affordable solar energy solutions to reduce electricity bills and promote a greener environment.

To make the process easy for applicants, the Bank of Punjab is offering fiscal assistance and straightforward registration procedures. In this guide, we will cover all you need to know about the scheme, including eligibility, benefits, and the application process.

More Read:Benazir Taleemi Wazaif Stipend

Quick Information Table

| Field | Details |

| Program Name | Solar Panel Financing Scheme |

| Assistance Amount | PKR [Updated Amount] |

| Method of Application | Online / Offline |

What is the Solar Panel Scheme?

The Solar Panel Scheme Registration launched by the Bank of Punjab is a backing creativity to help families and businesses install solar panels at reasonable rates. The aim is to support energy freedom, reduce trust on the national power grid, and promote the use of clean energy. This scheme offers loans with easy repayment options and low interest rates, making it easier for the general public to shift to solar energy.

Why is the Solar Panel Scheme Important?

Rising Energy Costs in Pakistan

With the constant increase in electricity prices, many families and businesses face challenges in managing their monthly bills. Solar energy provides a supportable solution to lessen electricity costs.

Environmental Impact

Using solar panels reduces the addiction on fossil fuels, which are harmful to the environment. By switching to solar power, you contribute to a help and greener Pakistan.

Energy Independence

Frequent power cuts and load-shedding are common in Pakistan. Solar panels provide an continuous power supply, reducing your reliance on the national grid.

More Read:Meezan Bank Apni Bike Scheme 2024

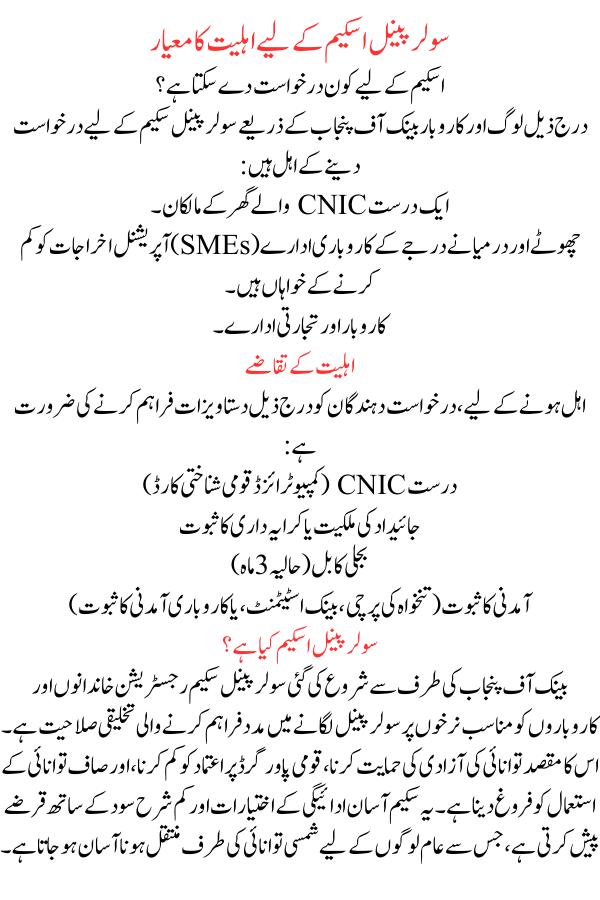

Eligibility Criteria for Solar Panel Scheme

Who Can Apply for the Scheme?

The following folks and businesses are eligible to apply for the Solar Panel Scheme through the Bank of Punjab:

- Homeowners with a valid CNIC.

- Small and Medium Enterprises (SMEs) looking to reduce operational costs.

- Businesses and Commercial Establishments.

Requirements for Eligibility

To be eligible, applicants need to provide the following documents:

- Valid CNIC (Computerized National Identity Card)

- Proof of Property Ownership or Tenancy

- Electricity Bill (Recent 3 Months)

- Income Proof (Salary slip, bank statement, or business income proof)

Benefits of the Solar Panel Scheme Registration

Financial Assistance

The Bank of Punjab offers financing options with good interest rates. This makes it cheap to install solar panels without a large upfront asset.

Lower Electricity Bills

Once the solar panels are installed, you can knowingly reduce your monthly power costs by generating your own power.

Flexible Repayment Plans

The scheme offers supple repayment plans that cater to different income levels, confirming affordability for everyone.

Eco-Friendly Solution

Solar energy is a renewable source, reducing your carbon footprint and causal to a cleaner environment.

More Read:Benazir Kafalat 13500 Registration

How to Apply for the Solar Panel Scheme Through Bank of Punjab

Step-by-Step Application Process

- Visit Your Nearest BOP Branch:

- Go to any Bank of Punjab branch and ask for the Solar Panel Scheme application form.

- Online Application:

- Alternatively, visit the official Bank of Punjab website and navigate to the solar financing section.

- Submit Required Documents:

- Provide the essential documents, including your CNIC, electricity bills, income proof, and property documents.

- Application Review:

- The bank will review your application and documents. You will be informed if additional information is needed.

- Approval and Installation:

- Once approved, the bank will release the funds, and you can ensue with the connection of solar panels.

Terms and Conditions of the Solar Panel Scheme Registration

- Loan Limit: Backing limits vary based on your income and electricity feasting.

- Repayment Period: The loan repayment period can be up to 5-7 years liable on the financing amount.

- Interest Rate: Good interest rates set by the Bank of Punjab.

- Verification Process: All applications go through a proof process to ensure eligibility and solvency.

More Read:CM Punjab Minority Card 2025

FAQs (Frequently Asked Questions)

How long does it take to get approval for the scheme?

The approval process classically takes 7-15 working days once all documents are submitted.

Is there any down payment required?

Yes, a small fraction of the total backing amount may be required as a down payment.

Can renters apply for this scheme?

Yes, renters can apply, but they need permission from the stuff owner and a valid rental contract.

What happens if I miss a loan payment?

Missing payments may lead to prices or additional charges. It is directed to keep up with your repayment schedule.

More Read: Free Tractors and Laser Land Levelers

Conclusion

The Solar Panel Scheme through the Bank of Punjab is an excellent chance for Pakistani households and businesses to switch to renewable energy. With financial assistance, low-interest loans, and easy registration, this scheme makes solar energy open to everyone. Not only does it help reduce electricity costs, but it also promotes a cleaner and more supportable future for Pakistan.