Sindh Bank Azadi Salary Loan for Government Employees

In the Pakistan, especially among government workers, financial emergencies often rise. From unexpected medical expenditures, wedding preparations, or urgent payments to educational requirements, a quick and dependable economic solution becomes indispensable. Recognizing these needs, Sindh Bank provided the Azadi Salary Loan, especially planned to meet the requirements of govt workers. This loan scheme is Shariah-compliant, confirming that customers knowledge peace of mind, knowing that their financial support aligns with Islamic principles and banking law. Sindh Bank’s Azadi Salary Loan is a keen product, particularly tailored to female govt employees who need economic support to bridge monthly income breaks and meet vital needs without hassle.

Here’s a complete overview and all information of Sindh Bank Salary Loan options, eligibility requirements, and full application process for the loan.

Also Read : Cost of Solar Panels in Pakistan: Complete Guide (2024)

What is Sindh Bank Salary Loan?

Sindh Bank Salary Loan is a unique product exactly planned to cater to the economic requirements of govt employees, contribution loan amounts ranging from PKR 50,000 to PKR 1,500,000 with elastic repayment terms of up to four years. This loan product is ideal for cover a range of expenditures, counting:

- Medical Emergencies

- Wedding Expenses

- Educational Needs

- Urgent Personal Payments

The Sindh Bank Salary Loan markup rate is extremely competitive, making it reasonable for those who need extra funding. With minimal documentation and no processing cost, this loan offers an easy and quickly solution.

Also Read : Prime Minister Youth Business Loan: A Comprehensive Guide

Key Features and Benefits

The Sindh Bank Azadi Salary Loan for govt employees offers numerous features tailored to meet the instant financial needs of customers. Here are the main features of this product:

- Loan Amount: PKR 50,000 to PKR 1,500,000

- Flexible Repayment: Up to 4 years

- Easy Documentation: Minimal paperwork ensures quick processing

- Discounted Mark-up Rates: Low-interest rates make it affordable

- No Processing Fees: Zero charges for application processing

Sindh Bank’s goal is to confirm financial stability for its customers by contribution a product that addresses common financial needs faced by govt employees in the Pakistan.

Benefits

Sindh Bank Loan for Govt Employees provides several rewards, making it the preferred option for those who need urgent funds. Here are some of the top profits:

- No Processing Fees: This feature confirms that there are no additional charges involved during the application.

- Prompt Processing: Sindh Bank provide quick approval and disbursement.

- Shariah Compliance: The product fulfils with Islamic banking principles, making it a dependable choice for those who prioritize Shariah-compliant products.

- Flexible Terms: Repayment terms are flexible, allowing clienteles to choose a plan that best fits their monthly income.

These profits make Sindh Bank Azadi Salary Loan an ideal choice for anyone looking for a dependable and reasonable financing result.

Also Read : CM Maryam Launches Shrimp Farming Internship Program for Youth

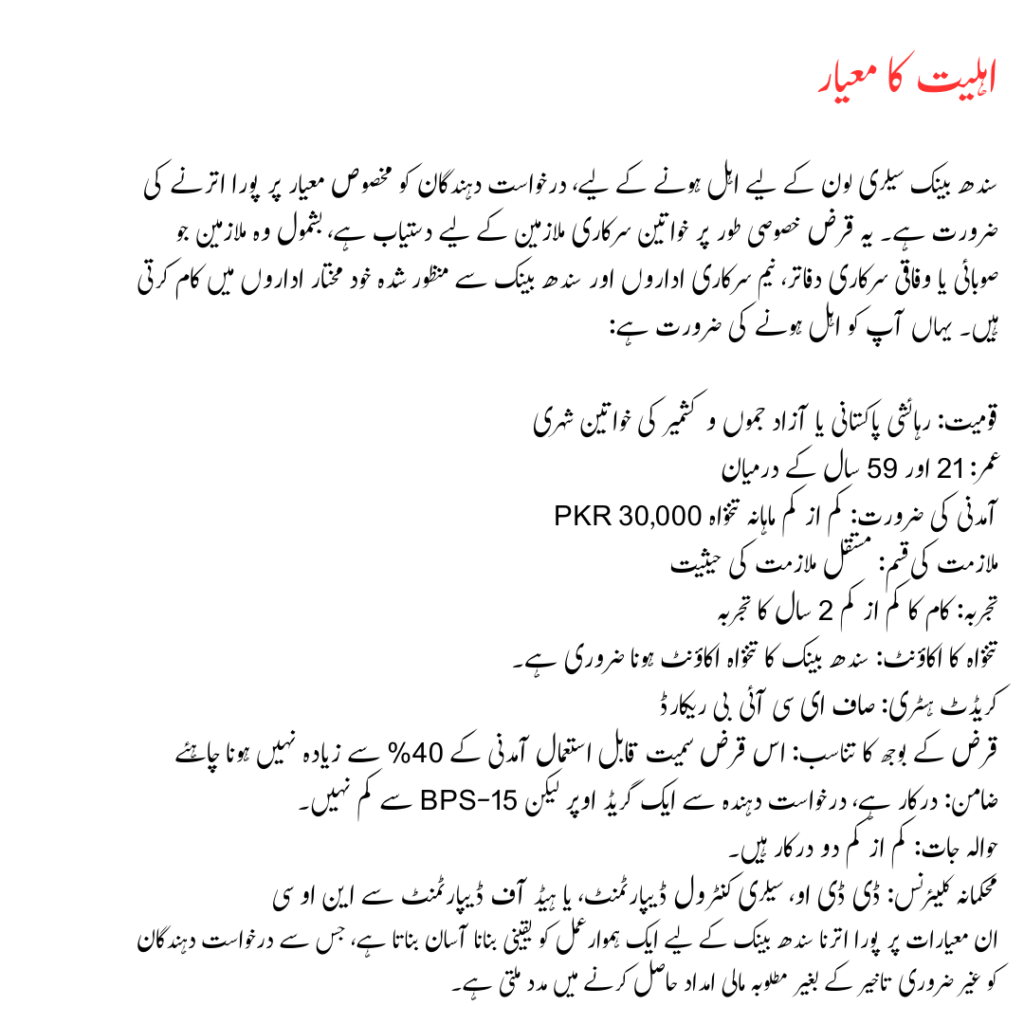

Eligibility Criteria

To qualify for the Sindh Bank Salary Loan, candidates need to meet exact criteria. This loan is completely available to female govt employees, including those working in district or federal govt offices, semi-govt organizations, and Sindh Bank-approved autonomous bodies. Here’s what you need to be eligible:

- Nationality: Resident Pakistani or AJK female citizens

- Age: Between 21 and 59 years

- Income Requirement: Minimum monthly salary of PKR 30,000

- Employment Type: Permanent employment status

- Experience: At least 2 years of work experience

- Salary Account: Must have a Sindh Bank salary account

- Credit History: Clean eCIB record

- Debt Burden Ratio: Should not exceed 40% of disposable income, including this loan

- Guarantor: Required, one grade above the candidate but not less than BPS-15

- References: Minimum of two required

- Departmental Clearance: NOC from DDO, Salary Control Department, or Head of Department

Meeting these criteria makes it easier for Sindh Bank to ensure a smooth process, helping applicants receive the financial support they need without needless delays.

Loan Calculator

Sindh Bank offers an online loan calculator to help customers guess monthly payments based on loan amount and repayment terms. This tool is particularly helpful for those planning to apply, as it provides a clear picture of financial obligations, making budgeting easier. You can entrée the loan calculator by visiting Sindh Bank’s official loan calculator .

How to Apply

Applying for the Sindh Bank Loan Online is straightforward. While the application process involves a few vital steps, following them will ensure prompt approval. Here’s how to proceed:

- Download the Application Form: You can download the form here.

- Print and Fill Out the Form: Once downloaded, fill out the necessary specifics carefully.

- Attach Required Documents: Gather the required credentials (salary slips, ID copies, references, etc.).

- Submit the Application: Visit the nearest Sindh Bank branch and submit the complete form along with attached documents.

This quick and hassle-free application process ensures that govt employees can apply for the loan without any difficulties.

Also Read : Sukoon Salary Loan: A Comprehensive Guide for Pakistani Citizens

FAQs

- Who can apply for the Sindh Bank Salary Loan?

Only permanent female employees of federal and provincial govt, semi-govt organizations, and Sindh Bank-approved independent bodies are eligible. - What is the maximum loan amount under this scheme?

The maximum loan amount available is PKR 1,500,000. - How long is the loan repayment period?

The loan can be repaid over a period of up to 4 years. - Is there any processing fee for the Sindh Bank Salary Loan?

No, Sindh Bank does not charge any processing fee for this loan. - How can I calculate my monthly installments?

You can calculate your repayments using the Sindh Bank Home Loan Calculator here. - What is the Sindh Bank Salary Loan markup rate?

Sindh Bank offers reduced markup rates for this loan, making it reasonable. - Can male government employees apply for this loan?

This particular loan is presently planned for female workers only. - What documents are required to apply?

Essential documents include a filled application form, salary slips, ID copies, references, and NOC from the relevant department. - How is the loan amount disbursed?

After approval, the loan amount is credited directly to the applicant’s Sindh Bank account. - How can I get more information about the Sindh Bank Salary Loan?

For further information, you can contact Sindh Bank’s customer service or visit the nearest branch.

Conclusion

The Sindh Bank Azadi Salary Loan provides an priceless financial solution for govt employees, mostly female staff, who may need emergency funding for personal, medical, or educational purposes. With its elastic terms, no processing fees, and Shariah-compliant structure, this loan confirms that customers receive reliable assistance tailored to their needs. By contribution a competitive Sindh Bank Salary Loan markup rate and a straightforward application process, Sindh Bank supports employees in managing urgent expenses without overburdening their finances.

If you’re a qualified govt employee and need immediate financial support, consider Sindh Bank’s Azadi Salary Loan as a trustworthy option. For further details or modified assistance, don’t hesitate to contact Sindh Bank’s customer service or visit your nearest branch.

For additional information, you may contact Sindh Bank directly through their official website or customer service help line. (+92-21-111-11-7632)