Roshan Apna Ghar Scheme: A Complete Guide

The Roshan Apna Ghar Scheme: A Complete Guide is an creativity launched by the State Bank of Pakistan (SBP) for overseas Pakistanis to invest in housing things in Pakistan. This Roshan Apna Ghar Scheme: A Complete Guide offers supple home financing options tailored for non-resident Pakistanis (NRPs) through their Roshan Digital Account (RDA). It allows NRPs to buy, build, or restore homes handily from abroad while enjoying secure contacts and smart financing rates.

More Read:Livestock Asset Cow Program Benefits Women

Quick Overview of Roshan Apna Ghar Scheme

| Feature | Details |

| Program Name | Roshan Apna Ghar Scheme |

| Start Date | August 2021 |

| Eligibility | NRPs with a valid Roshan Digital Account (RDA) |

| Financing Amount | Minimum PKR 500,000; Maximum varies by bank and financing type |

| Application Method | Online through participating banks |

| Types of Financing | Lien-based and Non-lien-based |

| Maximum Financing Tenor | Up to 25 years |

| Profit Rates | Fixed or variable rates available |

Key Features of the Roshan Apna Ghar Scheme:A Complete Guide

The Roshan Apna Ghar Scheme: A Complete Guide offers a range of options and features that make it likeable to overseas Pakistanis looking to invest in property in Pakistan.

- Ease of Application: NRPs can apply entirely online through their RDA, eliminating the need to visit Pakistan.

- Flexible Property Choices: Purchase pre-approved properties or any residential property in Pakistan.

- Two Types of Financing Options:

- Lien-Based Financing: Utilizes RDA balances or Naya Pakistan Certificates (NPCs) as collateral, offering up to 99% financing.

- Non-Lien-Based Financing: Mortgage-based financing, requiring an equitable mortgage on the purchased property and offering up to 85% of the property value

More Read:Step-by-Step Registration Process for Baitul-Mal Punjab

- Competitive Financing Rates: Borrowers can choose between fixed or variable rates based on Karachi Interbank Offered Rate (KIBOR) plus an additional margin for different financing types

- Repatriation Flexibility: NRPs can deport the principal amount invested in case of property sale without needing extra permissions

Types of Financing in Detail

- Lien-Based Financing

In lien-based financing, the loan amount is secured against the RDA balance or NPCs. This option allows:

- Financing up to 99% of the property’s value for grasps and structure.

- Simplified documentation, with all agreements signed digitally.

- No need for physical presence, making it ideal for NRPs who cannot travel to Pakistan

More Read:Chief Minister Punjab Roshan Gharana Scheme

- Non-Lien-Based Financing

Non-lien financing uses the property itself as collateral. Features include:

- Financing up to 85% of the property value.

- Requirement for the property to be mortgaged, and in some cases, applicants need a Power of Attorney.

- For renovation, financing is capped at 30% of the property value

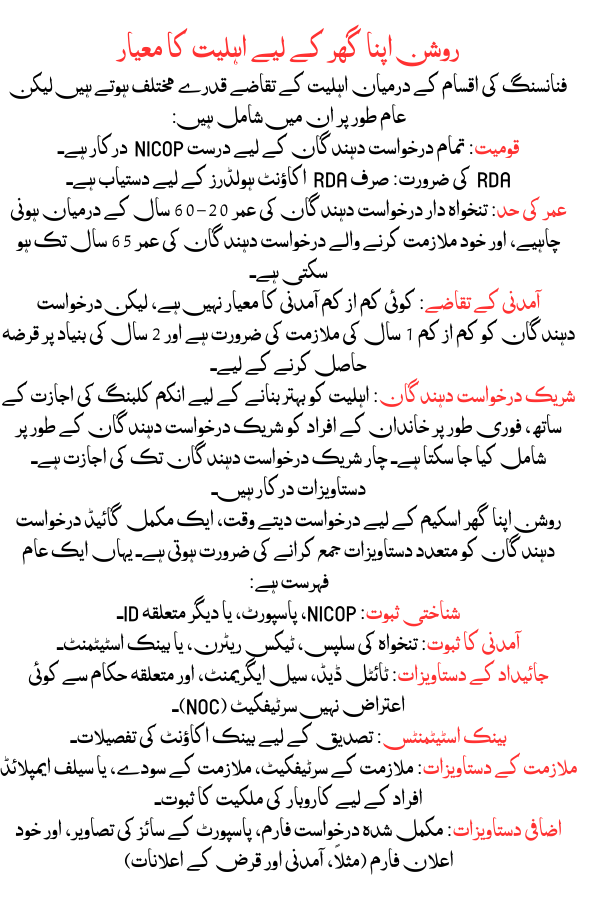

Eligibility Criteria for Roshan Apna Ghar Scheme : A Complete Guide

Eligibility requirements vary slightly between financing types but generally include:

- Nationality: Valid NICOP is required for all applicants.

- RDA Requirement: Only available to RDA account holders.

- Age Limit: Salaried applicants must be between 20–60 years, and self-employed applicants can be up to 65 years.

- Income Requirements: No minimum income criteria, but applicants need at least 1 year of employment for lien-based and 2 years for non-lien-based financing.

- Co-Applicants: Immediate family members can be included as co-applicants, with income clubbing allowed to improve eligibility. Up to four co-applicants are permitted

Documents Required

When applying for the Roshan Apna Ghar Scheme, A Complete Guide applicants need to submit a range of documents. Here is a general list:

More Read:15 Lakh Loan Program by Maryam Nawaz

- Identity Proof: NICOP, passport, or other relevant ID.

- Proof of Income: Salary slips, tax returns, or bank statements.

- Property Documents: Title deed, sale agreement, and No Objection Certificate (NOC) from relevant authorities.

- Bank Statements: Bank account details for verification.

- Employment Documents: Employment certificates, job deals, or business ownership proof for self-employed individuals.

- Additional Documents: Completed application form, passport-sized photographs, and self-declaration forms (e.g., income and loan declarations)

Frequently Asked Questions (FAQs)

Who is eligible for the Roshan Apna Ghar Scheme:A Complete Guide?

Only non-resident Pakistanis with a valid Roshan Digital Account can apply for this scheme.

Can I buy property without visiting Pakistan?

Yes, with lien-based financing, physical presence is generally not required. For non-lien-based financing, a Power of Attorney may be needed.

What is the minimum and maximum financing amount?

The financing amount starts from PKR 500,000, with upper limits subject on the type of financing and bank policies.

What is the tenure of the financing?

Financing tenures range from 3 to 25 years, giving give for longer-term investments.

More Read:Bank Alfalah Islamic Home Loan

Are there any special rates or incentives?

Both fixed and variable rates are available, with the choice of Shariah-compliant options for Islamic banking customers.

What are the processing fees?

Banks may charge treating fees, which vary but generally start around PKR 4,000 plus applicable taxes.

How to Apply Roshan Apna Ghar Scheme?A Complete Guide

To apply,Roshan Apna Ghar Scheme: A Complete Guide follow these simple steps:

- Open a Roshan Digital Account: This can be done through any joining Pakistani bank.

- Select the Financing Option: Choose lien-based or non-lien-based financing based on your preferences.

- Submit Required Documents: Upload necessary documents online through the bank’s portal.

- Approval and Disbursement: Once your application is approved, the financing amount is directly expended for property gaining

More Read:Roshan Gharana Solar Panel Scheme

Conclusion

The Roshan Apna Ghar Scheme A Complete Guide represents a important chance for overseas Pakistanis to invest in Pakistan’s real estate sector securely and conveniently. It is designed to empower NRPs with efficient processes, flexible funding options, and secure contacts. By meeting the certification and eligibility requirements, NRPs can take advantage of this scheme to realize their dreams of owning property in Pakistan with ease and fiscal benefits.