Prime Minister Youth Business Loan

The Prime Minister Youth Business Loan (PMYBL) is a important creativity by the Government of Pakistan to empower young industrialists by providing financial assistance to start or expand their businesses. The program aims to address youth unemployment and encourage self-reliance by offering affordable loans with minimal supplies. This article provides detailed information on the program, including eligibility criteria, application process, benefits, and more.

More Read:Shrimp Farming Internship Program for Youth

Quick Information Table

| Program Name | Prime Minister Youth Business Loan (PMYBL) |

| Start Date | Ongoing |

| End Date | Not specified (subject to fund availability) |

| Loan Amount | PKR 100,000 to PKR 25 million |

| Interest Rate | 0% to 7% (depending on the tier) |

| Application Method | Online (through designated bank portals) |

| Eligibility Age | 18 to 45 years |

| Purpose | Business start-up or expansion |

What is the Prime Minister Youth Business Loan?

The Prime Minister Youth Business Loan Scheme is a government-led originality designed to enable young Pakistanis by offering loans at backed interest rates. These loans enable persons to start a new business or grow an existing one, thus paying to economic development. The scheme is part of the government’s broader program to promote free enterprise and reduce idleness across Pakistan.

Key Objectives of the PMYBL

- Promote Entrepreneurship: Encourage youth to found their ventures.

- Reduce Unemployment: Offer financial support to create job opportunities.

- Economic Growth: Boost local industries and support small-to-medium enterprises (SMEs).

More Read:Sukoon Salary Loan

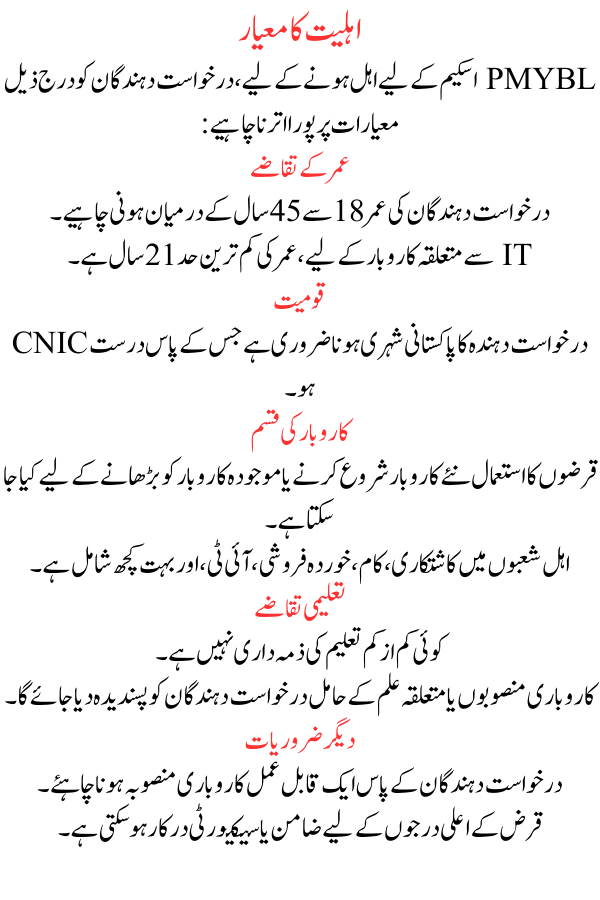

Eligibility Criteria

To qualify for the PMYBL Scheme, applicants must meet the following criteria:

Age Requirements

- Applicants should be between 18 and 45 years of age.

- For IT-related businesses, the lower age limit is 21 years.

Nationality

- The applicant must be a Pakistani citizen with a valid CNIC.

Business Type

- Loans can be used for starting new businesses or growing current ones.

- Eligible sectors include farming, work, retail, IT, and more.

Educational Requirements

- There is no minimum education obligation.

- Applicants with business plans or relevant knowledge will be given favorite.

Other Requirements

- Applicants should have a viable business plan.

- A guarantor or security may be required for higher loan tiers.

Loan Tiers and Interest Rates

The PMYBL scheme is divided into three tiers, each tailored to different business needs:

More Read:Interest Free Ehsaas Loan Program

Tier 1:

- Loan Amount: PKR 100,000 to PKR 500,000

- Interest Rate: 0% (interest-free loans)

- Collateral Required: No

Tier 2:

- Loan Amount: PKR 500,001 to PKR 7.5 million

- Interest Rate: 5%

- Collateral Required: Yes

Tier 3:

- Loan Amount: PKR 7.5 million to PKR 25 million

- Interest Rate: 7%

- Collateral Required: Yes

Application Process

Applying for the PMYBL Scheme is simple and chiefly conducted online. Follow these steps to submit your application:

Step 1: Prepare Necessary Documents

- CNIC (Computerized National Identity Card)

- Recent passport-sized photographs

- Proof of residence

- Business plan or feasibility study

- Guarantor details (if required)

More Read:Maryam Nawaz Loan Scheme 2024

Step 2: Visit the Official Website

Go to the Prime Minister Youth Program portal or the websites of joining banks.

Step 3: Complete the Application Form

Fill out the online application form accurately, providing all required details.

Step 4: Submit Required Documents

Upload scanned copies of your documents during the application process.

Step 5: Await Approval

Once submitted, the application will be reviewed. Successful applicants will be informed, and the loan amount will be disbursed to their account.

Participating Banks

Several leading banks in Pakistan are part of this scheme, including:

- National Bank of Pakistan (NBP)

- Habib Bank Limited (HBL)

- United Bank Limited (UBL)

- Bank of Punjab (BOP)

Applicants can choose their preferred bank based on nearness and location.

More Read:Solar Energy Revolution (PSER) 2024

Benefits of the PMYBL Scheme

For Entrepreneurs:

- Financial Independence: Easy access to funds for business growth.

- Low Interest Rates: Makes repayment more affordable.

- Skill Development: Heartens young people to acquire advanced skills.

For the Economy:

- Job Creation: New businesses provide employment chances.

- Industrial Growth: Increased investment in various sectors.

- Economic Stability: Promotes self-reliance and reduces import reliance.

Challenges and Solutions

While the PMYBL program is beneficial, some challenges may arise:

Common Challenges

- Lengthy Approval Process: Delays in loan disbursement.

- Lack of Awareness: Many eligible persons are unaware of the program.

Solutions

- Streamlined Processes: Digitization to speed up supports.

- Awareness Campaigns: Use social media and other stages to educate the public.

Frequently Asked Questions (FAQs)

Can women apply for the PMYBL?

Yes, the program encourages women to apply, and special reasons are available for female financiers.

Is there a deadline to apply?

There is no fixed deadline; applications are open subject to fund readiness.

More Read:LOLC Bank Salary Loan for Employees

Can multiple loans be availed under this program?

No, only one loan per separate is allowed.

Conclusion

The Prime Minister Youth Business Loan Scheme is a transformative vision that offers young Pakistanis the chance to achieve financial freedom and contribute to the country’s economy. With its user-friendly application process, supported interest rates, and wide eligibility criteria, this program is a game-changer for hopeful investors.