Life Insurance Scheme

The Khyber Pakhtunkhwa (KP) government has presented a innovative life insurance scheme aimed at if financial security and help to low-income families. This creativity is designed to support families who suffer the tragic loss of their primary worker, donation them timely monetary help during tough times. By introduction this scheme, the KP government aims to ease the economic hardships faced by the most vulnerable parts of society and deliver a safety net for those in need.

More Read:Minority Card Registration Closes on 5 January 2025

Quick Information Table

| Program Name | KP Low-Income Families Life Insurance Scheme |

| Start Date | 1st July 2024 |

| End Date | Ongoing |

| Amount of Assistance | Up to PKR 500,000 |

| Method of Application | Online and Offline |

| Target Audience | Low-income families in KP |

| Eligibility Criteria | Household income below PKR 25,000/month |

| Required Documents | CNIC, Death Certificate, Proof of Income |

Why is the KP Life Insurance Scheme Important?

In Pakistan, especially in provinces like KP, many families be contingent solely on the income of one distinct. If the primary earner suddenly passes away, the family can face extreme financial difficulties. This new life insurance scheme addresses this critical need, offering immediate fiscal support to help cover living costs, education outlays, and other supplies.

This initiative aims to:

- Provide Financial Security: Ensuring families receive return when they need it most.

- Reduce Poverty Levels: Stopping families from falling into deeper poverty.

- Ease Mental Stress: Offering peace of mind to low-income households.

More Read:Akhuwat Education Loan Apply 2025

Key Features of the Life Insurance Scheme

- Coverage Amount

Under this scheme, eligible families will receive financial return of up to PKR 500,000. This amount can be used for:

- Daily household expenses

- Children’s education

- Healthcare costs

- Emergency needs

- Simple Application Process

The KP government has ensured the application process is simple and handy for all. Applicants can apply both online and offline.

- Online Applications: Through the official KP government website, applicants can fill out a frank form and upload needed documents.

- Offline Applications: Families can visit chosen government offices to complete their applications.

More Read:Online Portal Introduced for Minority Card Registration

- Eligibility Criteria

To benefit from the scheme, families need to meet the following criteria:

- The deceased must have been the primary earner of the family.

- The total domestic income must be less than PKR 25,000 per month.

- The family must reside in Khyber Pakhtunkhwa.

- Valid ID and proof of income are required for verification.

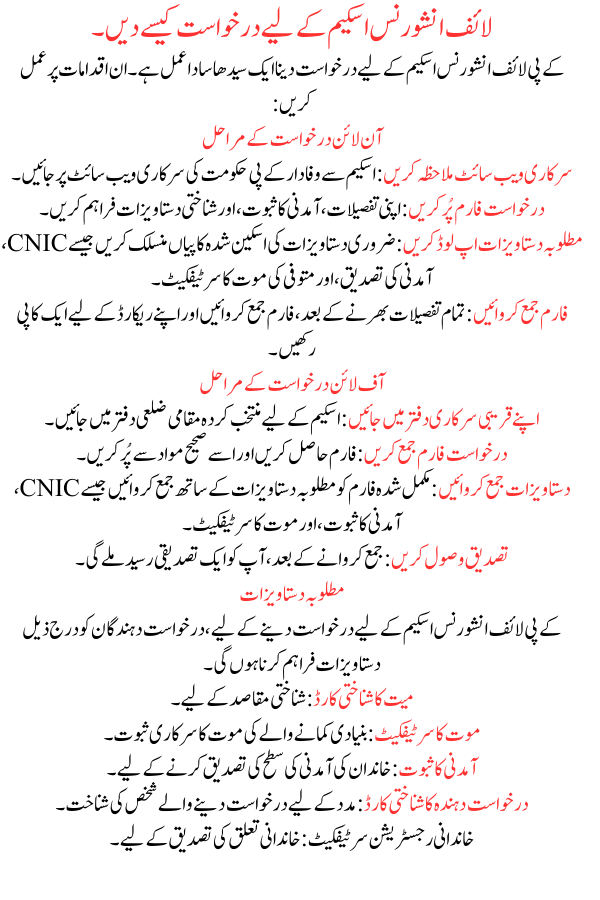

- Required Documents

To apply for the KP Life Insurance Scheme, applicants must provide the following documents:

- CNIC of the Deceased: For ID purposes.

- Death Certificate: Official proof of the death of the primary earner.

- Proof of Income: To verify the family’s income level.

- CNIC of the Applicant: ID of the person applying for help.

- Family Registration Certificate: To confirm family relationship.

- Fast-Track Claims Process

The KP government has streamlined the claims process to ensure quick expense of funds. After submitting the required documents, families can expect to receive financial support within 30 days.

- Transparency and Accountability

To ensure fairness, the government has applied strict measures to prevent fraud. Each application goes through a clear proof process to confirm eligibility before funds are released.

How to Apply for the Life Insurance Scheme

More Read:Mcb bank student loan apply online

Applying for the KP Life Insurance Program is a straightforward process. Follow these steps:

Online Application Steps

- Visit the Official Website: Go to the official KP government website loyal to the scheme.

- Fill Out the Application Form: Provide your own details, proof of income, and identification documents.

- Upload Required Documents: Attach scanned copies of necessary documents like CNIC, income verification, and death certificate of the deceased.

- Submit the Form: After filling in all details, submit the form and keep a copy for your records.

Offline Application Steps

- Visit Your Nearest Government Office: Go to a local district office chosen for the scheme.

- Collect the Application Form: Obtain the form and fill it out with correct material.

- Submit Documents: Submit the completed form along with required documents such as CNIC, proof of income, and death certificate.

- Receive Confirmation: Once submitted, you will receive a confirmation receipt.

Frequently Asked Questions (FAQs)

Who is eligible for the KP Life Insurance Program ?

Families with a household income below PKR 25,000 per month and who have lost their primary employee are eligible for this scheme.

How much financial assistance can we get?

Eligible families can receive up to PKR 500,000 in financial help.

How long does it take to process the claim?

Once the application and documents are submitted, claims are treated within 30 days.

More Read:Bank Alfalah Student Loan for Study Abroad

Can I apply both online and offline?

Yes, the application process supports both online and offline methods.

Where can I get more information?

Visit the official KP government website or contact your local district office for more details.

Conclusion

The KP Life Insurance Program for low-income families is a worthy creativity that talks a major need in society. By offering fiscal relief during times of tragic loss, the scheme ensures that families are not left to struggle alone. The simplified application process, large return amount, and clear system make it accessible and real.