Life Insurance Scheme

The government of Khyber Pakhtunkhwa (KP) has introduced a life insurance scheme designed to provide financial help to families who lose their primary workers. This initiative aims to support citizens facing financial hardships, especially among weak and low-income groups. Here is a complete guide covering all aspects of this scheme, from eligibility criteria to the application process.

More Read: Free Solar Panel Scheme in Punjab

Quick Overview of the KP Life Insurance Scheme

| Feature | Details |

| Program Name | KP Life Insurance Scheme |

| Start Date | December 2024 |

| End Date | Ongoing (long-term program) |

| Financial Assistance | Rs. 1 million (for deceased under 60 years) and Rs. 500,000 (for deceased 60+) |

| Application Method | Online and offline |

Key Features of the Scheme

- Comprehensive Support: Financial help of up to Rs. 1 million is if to families of deceased members, depending on their age.

- Target Audience: Aims to help families living below the poverty line, reducing the economic burden after the death of a breadwinner.

- Welfare Initiative: Part of the government’s vision to establish KP as a welfare province.

- Provincial Scope: Available to all people of Khyber Pakhtunkhwa, covering urban and rural populations.

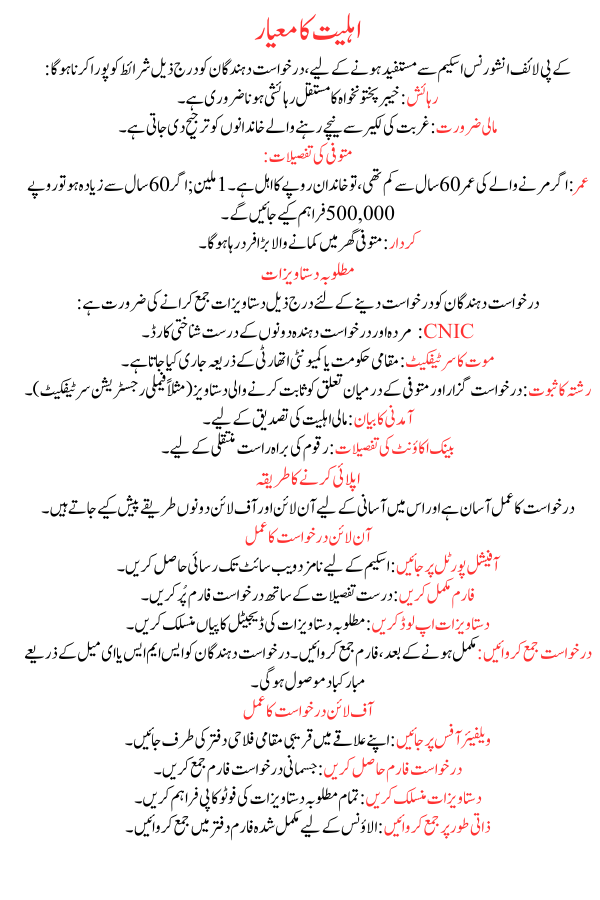

Eligibility Criteria

To benefit from the KP Life Insurance Scheme, applicants must fulfill the following conditions:

- Residency: Must be a enduring resident of Khyber Pakhtunkhwa.

- Financial Need: Priority is given to families living below the poverty line.

- Deceased’s Details:

- Age: If the dead was under 60 years, the family is eligible for Rs. 1 million; if over 60 years, Rs. 500,000 will be provided.

- Role: The deceased must have been the main earner in the household.

More Read:Get Money Through ATM from BISP

Required Documents

Applicants need to submit the following documents to apply:

- CNIC: Valid CNICs of both the dead and the applicant.

- Death Certificate: Issued by the local government or community authority.

- Relationship Proof: Document proving the relationship between the applicant and the deceased (e.g., family registration certificate).

- Income Statement: To confirm financial eligibility.

- Bank Account Details: For direct transfer of funds.

How to Apply

The application process is simple and offers both online and offline methods for handiness.

More Read:Benazir Kafalat Program 13500 Payment

Online Application Process

- Visit Official Portal: Access the designated website for the scheme.

- Complete the Form: Fill out the application form with precise details.

- Upload Documents: Attach digital copies of the required documents.

- Submit Application: Once completed, submit the form. Applicants will receive an greeting via SMS or email.

Offline Application Process

- Visit Welfare Office: Head to the nearest local welfare office in your area.

- Obtain Application Form: Collect the physical application form.

- Attach Documents: Provide photocopies of all required documents.

- Submit in Person: Submit the completed form at the office for allowance.

Expected Benefits

- Quick Financial Relief: Funds are expected to be paid within 30 days of verification.

- Improved Livelihoods: Helps families sustain themselves after the loss of their primary earner.

- Social Stability: Reduces the financial shock skilled by weak households.

FAQs

Who can apply for this scheme?

Any resident of Khyber Pakhtunkhwa who has lost a family member serving as the primary employee can apply, provided they meet the criteria.

Is this scheme limited to specific income groups?

Yes, families below the poverty line are arranged for this scheme.

How much financial assistance will I receive?

- Rs. 1 million for deceased under 60 years of age.

- Rs. 500,000 for deceased above 60 years.

Can applications be submitted for deaths before the scheme’s launch?

More Read:Ehsaas Apna Ghar Scheme 15 Lakh Loan for House

No, the scheme only covers deaths occurring after its statement.

How long does it take to process an application?

The entire process, from submission to fund payment, is expected to take around 30 days.

What happens if documents are incomplete?

Incomplete applications will not be processed. Applicants will be informed to provide the missing documents.

Conclusion

The KP Life Insurance Scheme is a commendable step toward creating a welfare-oriented society in Khyber Pakhtunkhwa. By offering financial assistance to families in their most weak moments, the government is ensuring social support and stability for its people. This creativity is part of a broader vision to reduce poverty and uplift the living standards of people in KP.