Kisan Card 30% Cash Withdrawal

The Kisan Card initiative by the Government of Pakistan empowers farmers with financial assistance and subsidies for agricultural needs. A key feature is the ability to withdraw 30% of the allocated subsidy funds in cash, providing farmers with immediate financial support to meet urgent requirements. This guide will explain the eligibility criteria, required documents, and the step-by-step application process, ensuring no farmer is left searching for additional information.

More Read:Sindh Bank Azadi Salary Loan

Quick Information Table

| Program Name | Kisan Card 30% Cash Withdrawal |

|---|---|

| Start Date | Ongoing |

| End Date | No specified end date |

| Assistance Amount | 30% of the allocated subsidy funds |

| Application Method | Online and Offline |

What Is the Kisan Card?

The Kisan Card is a revolutionary program aimed at supporting farmers across Pakistan. This card offers farmers direct access to subsidies on agricultural inputs like fertilizers, seeds, and pesticides. Additionally, it provides a 30% cash withdrawal facility, enabling farmers to use funds for urgent needs such as labor, fuel, or unexpected agricultural expenses.

This initiative ensures transparency and reduces the dependence on intermediaries, giving farmers control over their finances.

More Read:Ehsaas Nojawan Program

Benefits of the Kisan Card

The Kisan Card offers numerous advantages to farmers, such as:

- Subsidies on Inputs: Discounts on fertilizers, seeds, and pesticides.

- Cash Withdrawals: Farmers can withdraw 30% of their allocated funds for personal use.

- Direct Access: Eliminates middlemen, ensuring farmers receive benefits directly.

- Ease of Use: Functions like a debit card for financial transactions.

- Financial Flexibility: Addresses immediate financial requirements.

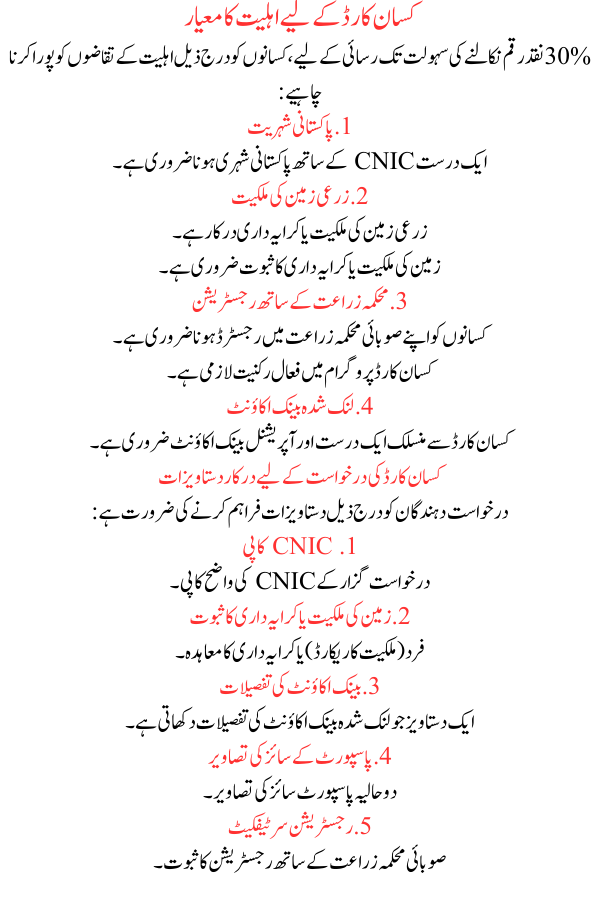

Eligibility Criteria for Kisan Card

To access the 30% cash withdrawal facility, farmers must meet the following eligibility requirements:

1. Pakistani Citizenship

- Must be a Pakistani citizen with a valid CNIC.

2. Agricultural Land Ownership

- Ownership or tenancy of agricultural land is required.

- Proof of land ownership or tenancy is necessary.

3. Registration with Agriculture Department

- Farmers must be registered with their provincial Agriculture Department.

- Active membership in the Kisan Card program is mandatory.

More Read:Sindh Bank Saadat Sukoon Salary Loan

4. Linked Bank Account

- A valid and operational bank account linked to the Kisan Card is essential.

Required Documents for Kisan Card Application

Applicants need to provide the following documents:

1. CNIC Copy

- A clear copy of the applicant’s CNIC.

2. Proof of Land Ownership or Tenancy

- Fard (ownership record) or tenancy agreement.

3. Bank Account Details

- A document showing the linked bank account details.

4. Passport-Sized Photographs

- Two recent passport-sized photographs.

5. Registration Certificate

- Proof of registration with the provincial Agriculture Department.

More Read:First Women Bank Salary Loan

How to Apply for the Kisan Card

Farmers can apply for the Kisan Card 30% cash withdrawal through online or offline methods.

1. Online Application Process

- Visit the official website of your provincial Agriculture Department.

- Register and create an account.

- Complete the Kisan Card 30% cash withdrawal application form with accurate details.

- Upload scanned copies of the required documents.

- Submit the application form.

- Upon verification, you will receive a notification to collect your card.

2. Offline Application Process

- Visit the nearest Agriculture Department office.

- Collect and fill out the application form.

- Attach the required documents.

- Submit the form at the counter.

- Once verified, the Kisan Card 30% cash withdrawal will be issued.

Steps to Withdraw 30% Cash Using the Kisan Card

Farmers can Kisan Card withdraw 30% of their subsidy funds through the following methods:

1. ATM Withdrawal

- Use the Kisan Card like a debit card 30% cash withdrawal at any ATM.

- Withdraw the allowed cash amount as per the allocated limit.

2. Over-the-Counter Withdrawal

- Visit the bank branch where the Kisan Card is registered.

- Provide identification and withdraw the funds over the counter.

3. Balance Inquiry

- Check the remaining subsidy amount through the ATM or the bank’s helpline.

More Read:Cost of Solar Panels in Pakistan

Key Points to Remember

- Ensure all information provided during the application is accurate.

- Keep the Kisan Card’s 30% cash withdrawal safe to prevent unauthorized access.

- Regularly check the subsidy balance to plan withdrawals effectively.

- The subsidy withdrawal limit and conditions are subject to government policies.

Conclusion

The Kisan Card’s 30% cash withdrawal facility is a lifeline for farmers in Pakistan, offering them much-needed financial flexibility. By meeting the eligibility criteria, preparing the required documents, and following the application process, farmers can benefit from this initiative without any hassle. This program not only supports agricultural productivity but also empowers farmers financially, ensuring a brighter future for Pakistan’s agricultural sector.