How to Get a JS Bank Salary Loan in Pakistan – Interest Rates, Requirements & Application Tips!

In the Pakistan workforce often seeks economic assistance to fulfill desires like home reconstructions, family holidays, or covering short-term expenditures. Many employees look for suitable, low-interest loan options, ideally linked to their salary accounts. If you’re one of them, JS Bank has a explanation that might suit you. The JS Elite Salary Loan offers elastic funding based on your monthly salary, allowing you to meet your economic goals without any annoyance.

This article will guide you on how to get a JS Bank salary loan, cover all important facts, eligibility criteria, interest rates, loan calculation, and the request process.

What is JS Bank Salary Loan?

JS Bank’s salary loan, also known as the JS Elite Salary Loan, is planned exactly for salaried people looking for a simple financing solution against their salary account. This loan benefits in managing unforeseen expenses or planned projects with elasticity and a fair interest rate. JS Bank offers loan amounts ranging from Rs. 40,000 to Rs. 4 million based on the borrower’s salary and account type, making it ideal for meeting both small and large economic needs.

JS Bank Loan Interest Rate

Understanding the JS Bank loan interest rate is important for anyone considering this facility. JS Bank provides two interest rate choices depending on the borrower’s circumstances and loan security:

Facility A: For borrowers who secure the loan through their employer’s comfort letter, the interest rate is 1-Year KIBOR + 8%. This rate is lower and more reasonable.

Facility B: For those who prefer a simpler process with only 2 Post-Dated Cheques, the rate is 1-Year KIBOR + 12%.

These rates are inexpensive, providing fair terms for borrowers, while meeting Islamic finance standards.

Key Features

The JS Elite Salary Loan is planned to cater to different financial desires and proposals a range of features, including:

- Loan Amount: Borrowers can access amounts from Rs. 40,000 up to Rs. 4 million based on eligibility.

- Loan Tenure: You can repay the loan in installments over a elastic period of up to 48 months.

- Early Settlement Option: A suitable feature allowing loan repayment before the term’s end with a small fee (5% of the remaining balance).

- Minimal Charges: The loan processing fee is Rs. 3,500 or 1% of the loan amount, whichever is higher.

This loan is mostly beneficial for Pakistani salaried persons looking to avoid complicated loan procedures.

Eligibility Criteria

To qualify for the JS Bank salary loan, borrowers must meet the following criteria:

- Account Requirements: Applicants must have a JS Elite or JS Elite Plus salary account with JS Bank.

- Age Requirement: The borrower should be between 21 and 60 years at loan maturity.

- Employment Status: Both enduring and contractual employees are eligible, provided their salary is credited into a JS Bank account.

- Income Requirement: Minimum gross monthly salary of Rs. 40,000.

These eligibility supplies are fairly accessible, making this loan a feasible option for a wide range of salaried individuals in Pakistan.

How to Apply

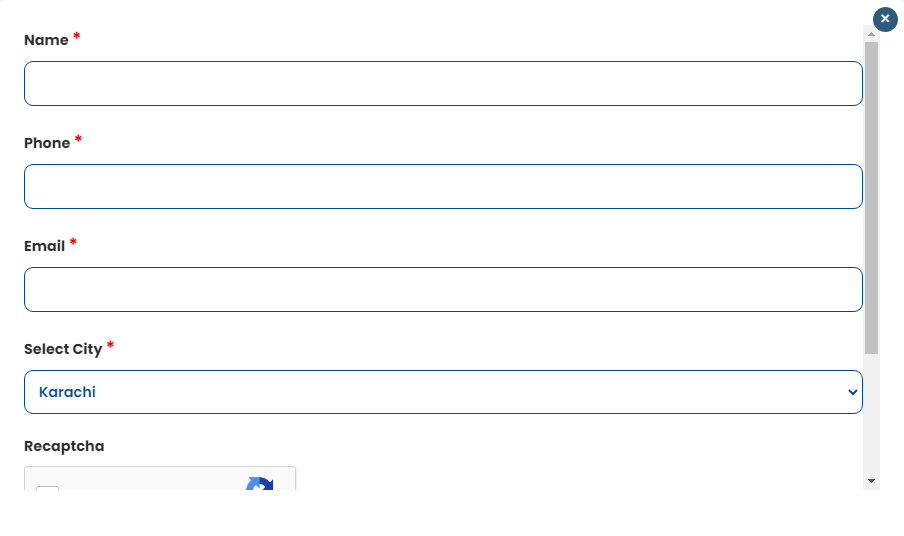

Applying for a JS Bank salary loan is upfront. Follow these steps to get started:

Visit the Official Website: Go to the JS Bank Elite Salary Loan page.

Fill the Online Form: Provide basic info like your name, phone number, email, and city.

Submit the Form: After submission, JS Bank will contact you within 2-3 business days to discuss the next steps.

Visit the Nearest Branch: For document verification and final dispensation, you’ll need to visit your nearest JS Bank branch with required documents.

The JS Bank team will guide you through each step, making the process smooth and efficient.

FAQs

1.What is the maximum loan amount I can get with JS Bank salary loan?

The max loan amount is Rs. 4 million for qualified customers.

- What is the interest rate for the JS Bank salary loan?

It depends on the facility type; Facility A offers 1-Year KIBOR + 8%, while Facility B offers 1-Year KIBOR + 12%.

- How long can I take to repay the loan?

You can repay the loan in up to 48 months.

- Can I settle my loan early?

Yes, JS Bank allows early payment with a fee of 5% on the remaining balance.

- What are the eligibility requirements?

You must have a JS Elite or JS Elite Plus account, be between 21 and 60 years old, and have a minimum salary of Rs. 40,000.

- Are there any processing fees?

Yes, a fee of Rs. 3,500 or 1% of the loan amount (whichever is higher) is charged.

- Do I need to provide any security for the loan?

It depends on the facility type. Facility A requires an employer’s comfort letter, while Facility B requires 2 Post-Dated Cheques.

- How can I calculate my monthly installment?

Use the JS Bank salary loan calculator available on their website.

- What documents do I need to apply?

Required documents typically include your CNIC, recent payslip, and employment verification letter.

- Where can I apply for this loan?

Apply online on the JS Bank website or visit your nearest branch.

Conclusion

The JS Elite Salary Loan from JS Bank is a appreciated option for salaried people in Pakistan who need elastic, easy-to-manage financing. With competitive interest rates and a simple application process, JS Bank caters to both direct and planned financial needs. For more information, you can also contact JS Bank directly or visit their nearest branch.

Take advantage of the JS Bank salary loan today and realize your economic goals handily and responsibly!