HBL Personal Loan Interest Rates in Pakistan

In difficult financial times, many people need quick access to funds to support their needs—whether it’s for a business, personal project, health expenses, or simply to get through a tough phase. For those seeking a reliable bank to apply for a personal loan, HBL (Habib Bank Limited) offers various loan solutions. In this article, we’ll break down the essential details regarding HBL personal loan interest rates, how much you can borrow, and the requirements you need to meet to avail this facility.

Also, if you are someone looking for Islamic banking options, we’ll discuss how some banks, like Meezan Bank, offer interest-free (riba-free) loans in compliance with Islamic law.

Overview of HBL Personal Loans

HBL’s personal loans are designed to provide financial assistance whenever you need it. Whether you’re facing a medical emergency, expanding your business, or planning for a significant event, this loan facility helps you realize your dreams and overcome financial hurdles. Here’s what HBL offers:

- Loan Amount: From PKR 25,000 to PKR 3,000,000.

- Repayment Period: Flexible tenure ranging from 12 to 48 months.

- Top-Up Facility: Available after every 12 months.

- Life Insurance: Coverage is provided, ensuring peace of mind.

The best part? You can apply for an HBL personal loan easily through the HBL Mobile App, making the process hassle-free and convenient. The following sections cover more about loan features, interest rates, and FAQs to make things easier to understand.

HBL Personal Loan Interest Rates and Features

When considering a personal loan, one of the first things people often look at is the interest rate. HBL offers competitive rates, but it’s essential to know the specifics:

- Interest Rate: The interest rate on HBL personal loans varies based on the amount borrowed, your employment status, and repayment tenure. For salaried individuals, the rates can start as low as 12% and vary depending on the loan’s conditions.

- Quick Processing: The loan application can be processed within a few days, with minimal paperwork required when applying via the HBL Mobile App.

- Easy Repayment Options: You can choose to repay the loan over 12 to 48 months, allowing you to manage your finances flexibly.

- No Collateral Required: HBL personal loans do not require any collateral, making it easier for customers to apply without worrying about asset pledges.

Benefits of HBL Personal Loans

HBL loans offer a wide array of benefits for customers, including:

- Flexible Loan Amounts: Borrow from PKR 25,000 to PKR 3,000,000.

- Life Insurance: Protect your loved ones with life insurance coverage attached to the loan.

- Top-Up Facility: Eligible customers can apply for additional funds after 12 months.

- Fast Processing: Get quick approval, especially through the mobile app, without going through tedious procedures.

How Much Loan Can You Get from HBL?

HBL offers flexibility when it comes to the loan amount. You can borrow as little as PKR 25,000 or go up to PKR 3,000,000, depending on your eligibility. Here’s what determines how much loan you can get from HBL:

- Income: Your monthly salary plays a key role in deciding the loan amount. The higher your income, the higher your loan eligibility.

- Repayment Capacity: HBL ensures that the loan amount aligns with your ability to repay. They consider your existing debts and other financial commitments.

- Age: HBL requires that applicants must be at least 21 years old when applying and not more than 60 years old when the loan matures.

For people who are in urgent need of money, HBL Ready Cash Loans provide an excellent option due to their easy approval process. However, if you’re looking for interest-free or Islamic loans, then it’s better to look at options offered by Meezan Bank and other Islamic banks.

HBL Ready Cash Loan Limit

For those who need a loan but don’t want a long-term commitment, HBL’s Ready Cash Loan is an attractive option. The loan limit for HBL Ready Cash typically depends on your income, account type, and the bank’s evaluation of your repayment ability. The maximum loan limit for Ready Cash is generally up to PKR 500,000, but it can be adjusted according to individual eligibility.

Loans via HBL Mobile App – Quick and Easy

One of the most convenient aspects of getting an HBL personal loan is that you don’t need to visit a branch. You can apply directly from the HBL Mobile App. Here are some benefits:

- No Paperwork: The process is entirely paperless. No forms, no documents to be submitted manually.

- Instant Evaluation: Once you submit the application via the app, the bank quickly evaluates your request and updates you about the status through SMS.

- Comfortable Experience: You can apply from the comfort of your home without the hassle of long bank queues.

Islamic Banking: Interest-Free Loan Options

For those looking for Islamic banking alternatives, Meezan Bank and other Islamic banks in Pakistan provide Shariah-compliant loans. These loans are free from interest (riba), aligning with the principles of Islamic finance. Meezan Bank offers loans for various purposes, including home financing, car loans, and personal finance, without charging any interest.

Islamic personal loans are structured differently. Instead of charging interest, they follow a profit-sharing model or rent-based contracts. This ensures that the loan is in line with Shariah law, which prohibits the use of interest-based financial transactions.

Meezan Bank’s Karobari Loan is a popular option for business owners who need funds but want to stay compliant with Islamic principles. Similarly, the Meezan Apna Ghar scheme allows people to buy homes without engaging in interest-based loans.

To get more details about interest-free loans, you can visit Meezan Bank’s website or contact their helpline for guidance.

HBL Personal Loan Application Requirements

If you’re ready to apply for an HBL personal loan, here’s what you’ll need:

- CNIC: A verified copy of your Computerized National Identity Card.

- Salary Slip: For salaried individuals, a recent verified salary slip is required.

- Employer Letter: If applicable, a letter from your employer confirming your employment status.

- Age: Applicant must be 21 to 60 years old.

How to apply

If you want to apply for an HBL personal loan online, the process is quick and hassle-free. You can submit your application through the HBL Mobile App or visit the official website. To start your loan application now, simply click on this link: Apply for HBL Personal Loan.

FAQs about HBL Personal Loan and Interest Rates

1.How much can I borrow from HBL?

You can borrow between PKR 25,000 to PKR 3,000,000 based on your eligibility.

2. What is the interest rate for HBL personal loans?

The interest rate starts from 12%, depending on the loan terms and conditions.

3. How can I apply for an personal loan?

You can apply through HBL branches or the HBL Mobile App.

4. Is there any collateral required?

No, HBL personal loans do not require any collateral.

5. What is the maximum repayment tenure?

The loan can be repaid over a maximum of 48 months.

6. Can I apply for an HBL loan online?

Yes, you can apply online via the HBL Mobile App.

7. Does HBL offer interest-free loans?

No, HBL does not offer interest-free loans. However, Islamic banks like Meezan Bank provide interest-free loans.

8. What happens if I miss an installment?

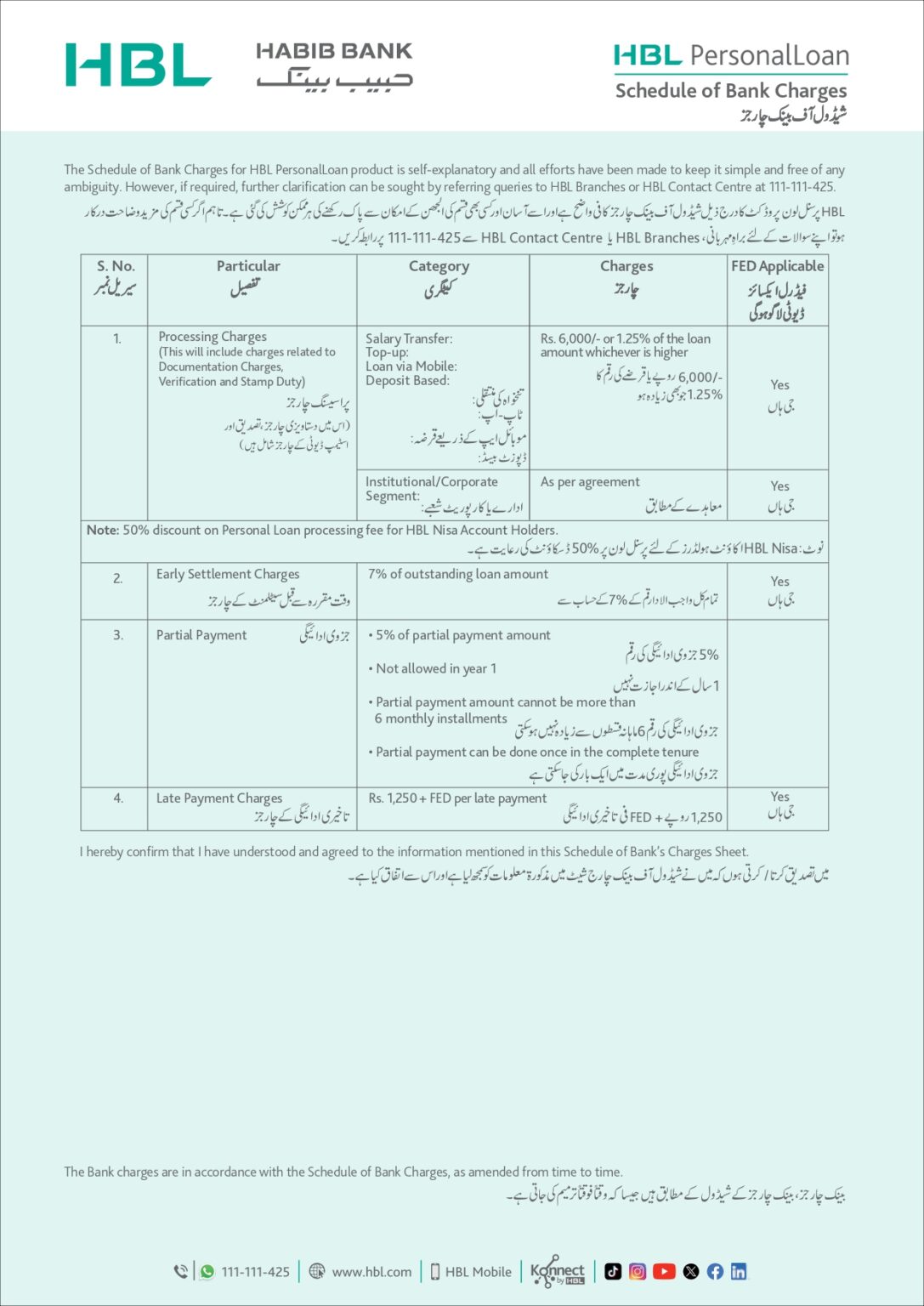

Late payment charges will apply as per HBL’s Schedule of Bank Charges.

9. Can I top up my loan?

Yes, HBL offers a top-up facility after 12 months of the initial loan.

10. What is the processing fee for an HBL personal loan?

Processing fees are applied as per the bank’s policy, and they are charged upfront post disbursement.

Conclusion

HBL’s personal loan facility offers financial support when you need it the most. Whether you’re facing an emergency or planning a big purchase, HBL provides flexible loan amounts and convenient repayment options. For those seeking Islamic banking options, consider Meezan Bank’s riba-free solutions.

For more detailed information, you can visit HBL’s official website or contact their customer service for personal guidance.