Ehsaas Apna Ghar Scheme 15 Lakh Loan

The Ehsaas Apna Ghar Scheme is a flagship initiative by the Government of Pakistan aimed at providing cheap housing loans of up to PKR 15 lakh (1.5 million) for low-income families. This program is a step toward confirming that every citizen has access to safe and secure housing. It offers financial assistance with flexible repayment options, making home ownership a reality for many. Below, we provide a detailed overview to help you understand the scheme, eligibility criteria, application process, and more.

More Read:Benazir Kafalat Quarterly Payment Increased

Quick Information Table

| Name of Program | Ehsaas Apna Ghar Scheme |

| Start Date | Announced in 2024 |

| End Date | Ongoing |

| Loan Amount | Up to PKR 15 lakh |

| Application Method | Currently offline, online coming soon |

| Repayment Period | Flexible (up to 20 years) |

| Eligibility | Low-income families, Pakistani citizens |

Ehsaas Apna Ghar Scheme

The Ehsaas Apna Ghar Scheme 15 Lakh Loan is part of the broader Ehsaas program, focusing on poverty alleviation and housing affordability. It aims to provide shelter to families who lack resources to build or purchase their own homes. By offering backed loans with easy repayment terms, the scheme seeks to improve living standards and address Pakistan’s growing housing shortage.

Objectives of the Scheme

- Housing for All: Secondary the dream of home ownership for low-income families.

- Economic Upliftment: Boosting the housing sector and creating job opportunities.

- Transparency: Ensuring fair loan allocation and minimal government.

More Read: Benazir Kafalat 3rd Phase Payments Start Today

Loan Details

- Financial Assistance

The program provides loans of up to PKR 15 lakh for building, purchasing, or renovating a house. The interest rates are heavily backed, ensuring affordability. Depending on your income level, you may qualify for additional benefits such as grace periods before repayment begins.

- Easy Repayment Plan

Borrowers can repay the loan over a flexible period of up to 20 years. This extended timeline ensures that families are not exploited while repaying their housing loans.

- Revolving Fund System

A unique rotating fund system ensures that repayments are recycled to help more families benefit from the scheme. This sustainable approach increases the program’s impact across Pakistan.

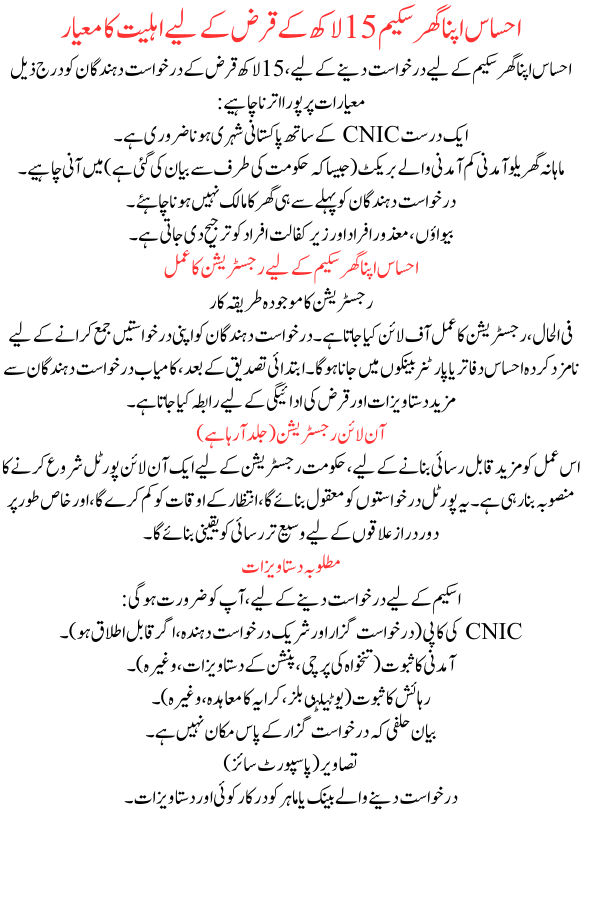

Eligibility Criteria for Ehsaas Apna Ghar Scheme 15 Lakh Loan

To apply for the Ehsaas Apna Ghar Scheme,15 Lakh Loan applicants must meet the following criteria:

More Read:BISP 8171 New Bank Account Payment System Update

- Must be a Pakistani citizen with a valid CNIC.

- Monthly household income should fall within the low-income bracket (as defined by the government).

- Applicants should not already own a house.

- Priority is given to widows, differently-abled persons, and those with dependents.

Registration Process for Ehsaas Apna Ghar Scheme

Current Registration Procedure

Currently, the registration process is conducted offline. Applicants need to visit designated Ehsaas offices or partner banks to submit their applications. After initial verification, successful applicants are contacted for further documentation and loan payment.

Online Registration (Coming Soon)

To make the process more accessible, the government is planning to launch an online portal for registrations. This portal will rationalize requests, reduce wait times, and ensure wider reach, chiefly for remote areas.

Required Documents

To apply for the scheme, you will need:

More Read:CM Punjab’s Child Surgery Initiative

- Copy of CNIC (applicant and co-applicant, if applicable).

- Proof of Income (salary slip, pension documents, etc.).

- Proof of Residency (utility bills, rent agreement, etc.).

- Affidavit declaring that the applicant does not own a house.

- Photographs (passport-sized).

- Any other documents required by the applying bank or expert.

Implementation Partners and Transparency

The Ehsaas Apna Ghar Scheme is implemented through teamwork with partner banks, housing finance organizations, and microfinance organizations. The government has stressed transparency by:

- Utilizing digital tools for loan tracking.

- Conducting third-party audits.

- Publishing regular progress reports.

Major Partner Banks

- National Bank of Pakistan (NBP)

- Bank of Punjab (BoP)

- First Women Bank Limited (FWBL)

Broader Government Initiatives

The Ehsaas Apna Ghar Scheme aligns with Pakistan’s larger agenda for poverty reduction and affordable housing:

More Read:Gifted Scholarship Program

- Naya Pakistan Housing Program: This creativity complements the Ehsaas Apna Ghar Scheme by providing additional housing solutions.

- Kamyab Pakistan Program: Offers small loans to empower micro-entrepreneurs and low-income families.

- Prime Minister’s Ehsaas Program: A broad range of social welfare programs, including education, healthcare, and financial presence.

Conclusion

The Ehsaas Apna Ghar Scheme 15 Lakh Loan is a transformative initiative for low-income families in Pakistan, offering affordable housing loans of up to PKR 15 lakh with flexible repayment terms. By addressing housing needs and promoting financial inclusion, the program plays a crucial role in improving the quality of life for countless families