Apna Karobar Loan Scheme Apply Online: Empowering Small Businesses in Pakistan

In the Pakistan, many impresarios and small business owners face challenges in behind or expanding their industries, especially when unforeseen dead or economic crises occur. To help such persons, the U Microfinance Bank provided the Apna Karobar Loan Scheme. This initiative is planned to empower micro-entrepreneurs by providing interest-free loans that adhere to Islamic financial principles and banking law, creation it reachable for those looking for Shariah-compliant funding to grow or steady their trades.

This article provides a full guide on the Apna Karobar Loan in Pakistan, with how to apply, eligibility criteria, obligatory documents, and answers to frequently asked questions. The goal is to give business-owners, with those in the medical and other fields, a frank path to access the funds they need to succeed.

What is the Apna Karobar Loan Scheme?

The Apna Karobar Loan Scheme by U Microfinance Bank is a economic support program aimed at small business owners and businesspersons in Pakistan who need direct capital to manage or increase their ventures. This arrangement allows persons to secure a loan of up to PKR 350,000, with elastic repayment terms and no interest, making it perfect for those looking to recover or grow their businesses without the economic pressure of high-interest loans.

This scheme is exactly planned to support:

- Micro-entrepreneurs who need wealth to buying assets.

- People in need of working capital for daily business actions.

- Business owners who may have confronted losses and are looking for economic support to restart.

Key Features of the Apna Karobar Loan Scheme

The Apna Karobar Loan Scheme offers several profits for small business owners. Here’s a breakdown of its key features:

Loan Amount: Candidates can contact funds of up to PKR 350,000, conditional on their business needs and repayment capability.

Repayment Tenure: Loan payment terms range from 6 to 24 months, allowing for controllable monthly repayments.

Insurance Coverage: The loan contains free insurance coverage in case of death or permanent incapacity, which reduces economic risk for the borrower’s family.

Guarantee Requirement: This loan is provided against a personal promise, confirming the lender’s security without needful complex collateral.

Equal Monthly Installments: Payment is made easier with fixed, equal monthly installments, helping business owners cheap more efficiently.

Benefits of the Apna Karobar Loan Scheme

For small business owners and persons affected by economic setbacks, the Apna Karobar Loan offers several profits that make it an beautiful special:

- Interest-Free: As a Shariah-compliant loan, it aligns with Islamic financial principles and banking law , contribution a zero-interest funding option.

- Quick Access to Capital: The loan enables micro-entrepreneurs to access capital promptly, which is especially valuable in emergencies or times of financial strain.

- Flexible Repayment Terms: With repayment terms straddling from 6 to 24 months, business owners have the flexibility to manage repayments according to their financial circumstances.

- Insurance for Financial Protection: The loan contains free coverage, ensuring that in case of death or disability, the residual burden doesn’t fall on the family.

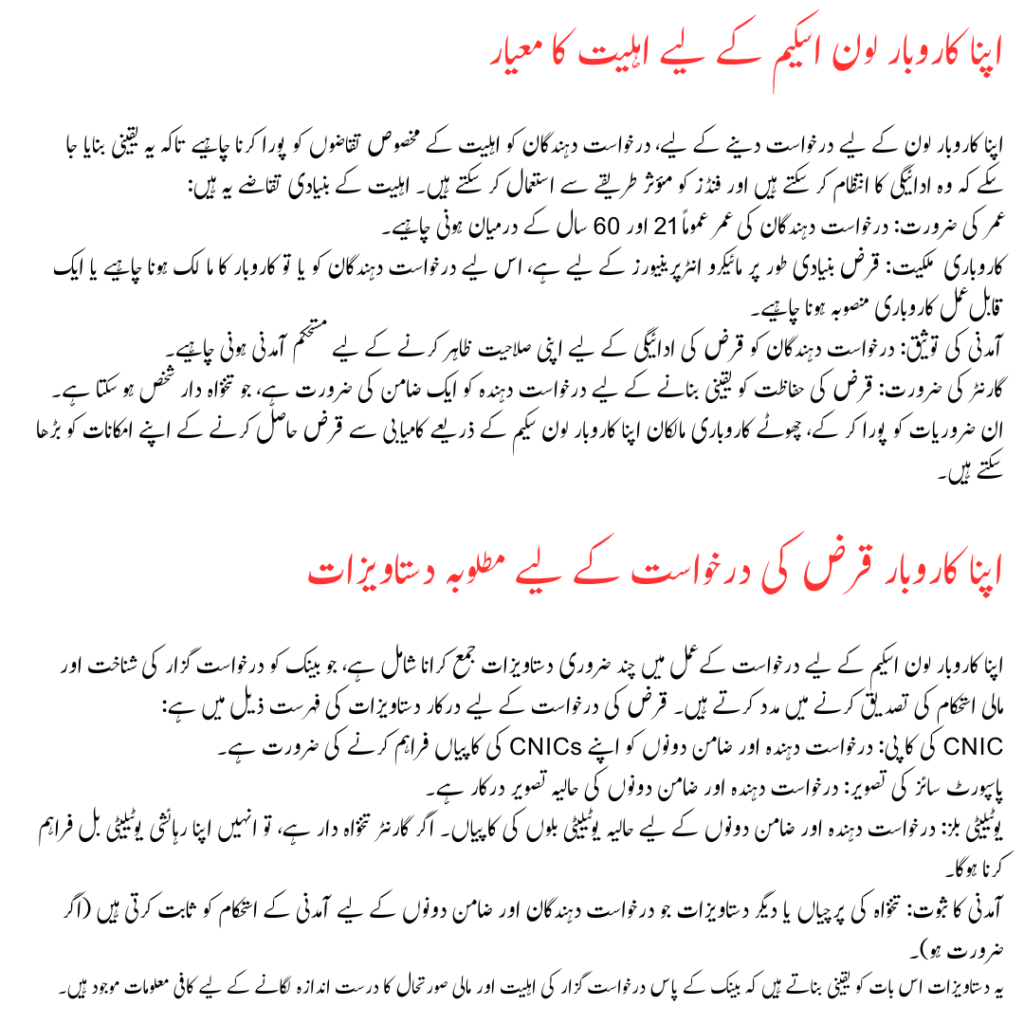

Eligibility Criteria for the Apna Karobar Loan Scheme

To apply for the Apna Karobar Loan, candidates must meet exact eligibility supplies to ensure they can manage the repayment and use the funds efficiently. Here are the primary eligibility requirements:

Age Requirement: Candidates must typically be between 21 and 60 years old.

Business Ownership: The loan is primarily planned for micro-entrepreneurs, so candidates must either own a business or have a possible business plan.

Income Verification: Candidates must have a stable income to show their competence for loan repayment.

Guarantor Requirement: The candidate needs a guarantor, who may be a paid person, to ensure loan security.

By meeting these requirements, small business owners can increase their chances of positively obtaining a loan through the Apna Karobar Loan .

Required Documents for Apna Karobar Loan Application

The application process for the Apna Karobar Loan Scheme includes submitting a few essential documents, which help the bank verify the candidate’s identity and financial stability. Below is the list of documents required for the loan request:

Copy of CNIC: The candidate and guarantor both need to provide copies of their CNICs.

Passport Size Photograph: A recent photograph of both the applicant and the guarantor is required.

Utility Bills: Copies of recent utility bills for both the candidate and the guarantor. In case the guarantor is salaried, they must provide their residential utility bill.

Proof of Income: Salary slips or other credentials proving income stability for both applicant and guarantor (if required).

These documents confirm that the bank has enough information to assess the applicant’s eligibility and financial condition accurately.

How to Apply for Apna Karobar Loan

To apply for the Apna Karobar Loan Scheme online or at a Ubank branch, here is a step-by-step guide:

Visit the Nearest Ubank Branch: While online requests are becoming more reachable, it’s currently recommended to visit your nearest U Microfinance Bank branch to discuss the loan application right with bank representatives.

Complete the Application Form: At the branch, you’ll be provided with an application form. Fill it carefully with correct information to avoid delays in processing.

Submit the Required Documents: Bring all obligatory documents as listed above. Bank staff will review and verify these during the request process.

Review and Submit: Ubank governments will help you confirm your application. After submission, the bank will review your eligibility, and if approved, you will accept the loan amount in your bank account within a few working days.

FAQs

Who is eligible for the Apna Karobar Loan Scheme?

The loan scheme is open to micro-entrepreneurs, with those in various expert fields, who meet the age and income requirements.

What is the maximum loan amount under this scheme?

The Apna Karobar Loan provides loans of up to PKR 350,000.

Is this loan Shariah-compliant?

Yes, U Microfinance Bank provides the loan following Islamic finance principles and banking law, ensuring it’s interest-free.

What documents are required to apply for this loan?

The main documents required are CNIC copies of the applicant and guarantor, passport-sized pictures, and current utility bills.

How can I apply for the Apna Karobar Loan Scheme online?

Currently, visiting a Ubank branch is recommended, although online services may soon be accessible.

How long does it take for loan approval?

Approval typically takes a few working days after submitting all obligatory documents.

Is there any insurance coverage with this loan?

Yes, the loan comes with free insurance in case of death or permanent disability.

What is the repayment period for this loan?

Repayment terms vary from 6 to 24 months, with equal monthly installments.

Can I apply without a guarantor?

A guarantor is required for this loan to secure the bank’s interest and meet suitability criteria.

Where can I get more details about the loan?

You can visit the U Microfinance Bank branch near you or contact their customer service for more information.

Conclusion

The Apna Karobar Loan by U Microfinance Bank provides an helpful support system for small business owners and people looking to stabilize or grow their businesses. This Shariah-compliant, interest-free loan confirms that Pakistani entrepreneurs have access to the resources needed to overcome financial challenges and drive their ventures forward.

For more details, you can contact the Ubank customer service number or visit the nearest branch to discuss your exact needs with a representative. This supportive loan scheme is a step forward in empowering Pakistan’s micro-entrepreneurs, offering them a pathway to success and financial independence.