Punjab Rozgar Scheme Apply Online

The Punjab Rozgar Scheme Apply Online is an initiative by the Government of Punjab to support small and medium enterprises (SMEs) and encourage free enterprise through backed loans. Managed by the Punjab Small Industries Corporation (PSIC) in collaboration with the Bank of Punjab, the program provides financial assistance to persons looking to start or expand businesses. Below, you will find complete info about the scheme, including eligibility, application process, required documents, and more.

Quick Information Table

| Feature | Details |

| Program Name | Punjab Rozgar Scheme |

| Start Date | Ongoing |

| Loan Amount | Rs. 100,000 to Rs. 10,000,000 |

| Interest Rate | 4% (clean loan), 5% (secured loan) |

| Application Method | Online via the official portal: rozgar.psic.punjab.gov.pk |

| Loan Tenure | 2 to 5 years (including a 6-month grace period) |

| Processing Fee | Rs. 2,000 (non-refundable) |

| Eligibility | Residents of Punjab, aged 20–50, with entrepreneurial skills |

Eligibility Criteria

To qualify for the Punjab Rozgar Scheme Apply Online, applicants must meet the following requirements:

- Age Limit: 20 to 50 years.

- Gender: Open to all—males, females, and transgender individuals.

- Residence: Applicants must be permanent residents of Punjab, verified through their CNIC.

- Qualification/Experience:

- University or college graduates with entrepreneurial skills.

- Diploma or certificate holders from technical or vocational institutes.

- Skilled workers and artisans.

- Business Type: Both new startups and existing businesses are eligible.

- Loan Purpose: For business growth, startups, trading, rural, industrial, and services.

Features of the Scheme

- Loan Amount:

- Clean Loan: Rs. 100,000 to Rs. 1,000,000 (requires personal guarantees).

- Secured Loan: Rs. 1,000,001 to Rs. 10,000,000 (requires property or asset-based security).

- Debt-to-Equity Ratio:

- For males: 80:20.

- For females, transgender persons, and differently-abled people: 90:10.

- Interest Rate:

- Clean loans: 4% per annum.

- Secured loans: 5% per annum.

- Repayment Terms: 2 to 5 years, with a grace period of 6 months.

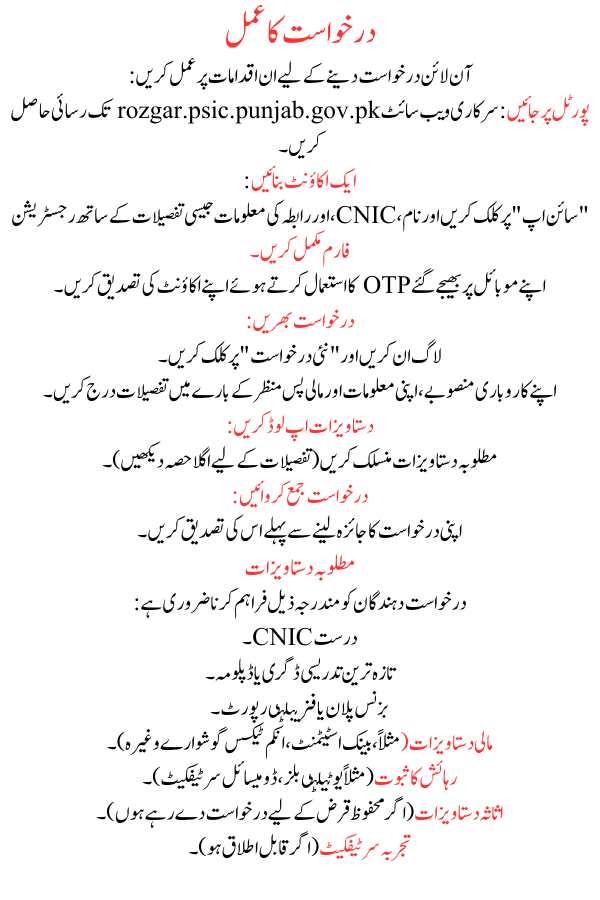

Application Process

Follow these steps to apply online:

- Visit the Portal: Access the official website rozgar.psic.punjab.gov.pk.

- Create an Account:

- Click “Sign Up” and complete the registration form with details like name, CNIC, and contact information.

- Verify your account using the OTP sent to your mobile.

- Fill the Application:

- Log in and click “New Application.”

- Enter details about your business plan, own information, and financial background.

- Upload Documents:

- Attach required documents (see the next section for details).

- Submit Application:

- Review and confirm your application before succumbing it.

- Review and confirm your application before succumbing it.

Required Documents

Applicants must provide the following:

- Valid CNIC.

- Latest instructive degree or diploma.

- Business plan or feasibility report.

- Financial documents (e.g., bank statements, income tax returns, etc.).

- Proof of residence (e.g., utility bills, domicile certificate).

- Asset documents (if applying for a secured loan).

- Experience certificates (if applicable).

Benefits of the Punjab Rozgar Scheme

- Affordable Financing: Low interest rates to encourage entrepreneurship.

- Inclusive Opportunities: Special debt-to-equity ratios for women, transgender individuals, and differently-abled people.

- Job Creation: Encourages economic growth by supporting startups and business expansions.

- Flexible Repayment Options: Easy repayment terms, including a grace period.

- Sector-wide Coverage: Loans existing for various businesses, including agriculture, trading, and services.

Conclusion

The Punjab Rozgar Scheme Apply Online is a complete program aimed at empowering entrepreneurs in Punjab. With its low-interest rates, easy application process, and inclusive policies, it offers a golden opportunity for individuals looking to start or grow their businesses. By addressing key challenges such as lack of access to financing, the scheme plays a vital role in firming the province’s economic fabric.

Frequently Asked Questions (FAQs)

Can a government employee apply for the Punjab Rozgar Scheme?

No, this scheme is designed for individuals without regular income, focusing on underprivileged groups.

What is the loan repayment period?

The repayment period ranges from 2 to 5 years, including a 6-month grace period.

How can I track my application status?

Applicants can track their application status on the official portal.

Is there an application deadline?

No specific deadline is mentioned; applications are known on a rolling basis.