Solar Panel Financing Scheme

With the rising demand for renewable energy in Pakistan, the Government of Punjab has launched a solar panel financing scheme to support its citizens in accepting solar energy. This program aims to provide financial help to households and businesses, allowing them to install solar systems with easy financing options. Here’s a complete guide to understanding the eligibility criteria, benefits, and application process for Punjab’s solar panel financing program.

More Read:Solar Financing from Sindh Bank

| Program Name | Punjab Solar Panel Financing Scheme |

| Start Date | January 2024 |

| End Date | December 2024 (or until funds last) |

| Assistance Amount | Up to PKR 500,000 |

| Application Method | Online through official Punjab Energy website |

What Is Punjab’s Solar Panel Financing Scheme?

The Punjab Solar Panel Financing program is an creativity by the local government to boost solar power usage, making it more accessible and affordable for people. This program focuses on reducing electricity costs for households and businesses, improving energy efficiency, and helping supportable development.

Benefits of Installing Solar Panels Through This Scheme

Installing solar panels can reduce electricity bills pointedly while providing a reliable power source. Here are some key benefits:

- Cost Savings:Reduced monthly electricity bills due to a decrease in grid reliance.

- Sustainability:Causative to a greener environment by using renewable energy.

- Low-Interest Loans:Easier access to financing at supported rates.

- Increased Property Value:Properties with installed solar systems are often valued higher.

More Read:Punjab Roshan Gharana Scheme

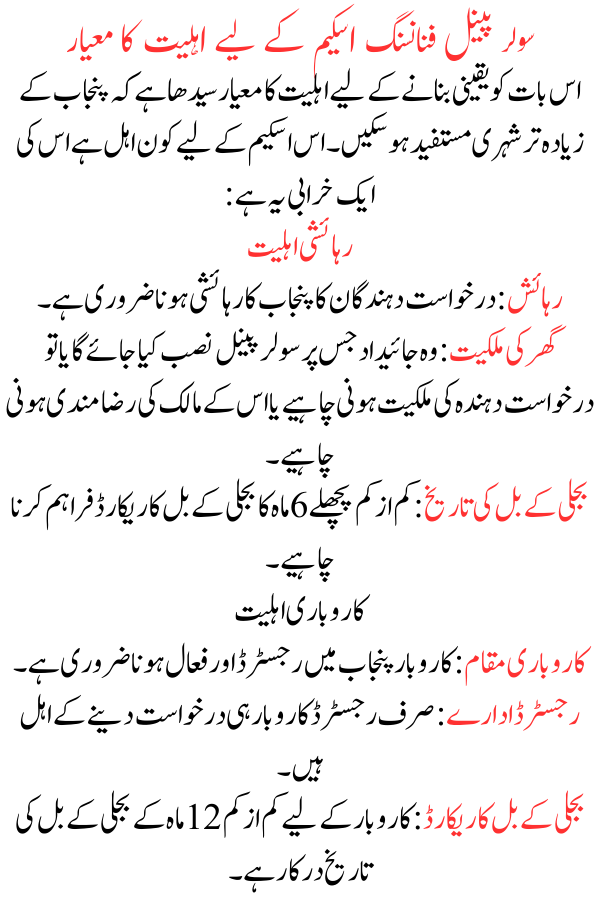

Eligibility Criteria for the Solar Panel Financing Scheme

The eligibility criteria are straightforward to ensure that most citizens of Punjab can benefit. Here’s a breakdown of who qualifies for the scheme:

- Residential Eligibility

- Residency: Applicants must be residents of Punjab.

- Homeownership: The property on which the solar panel will be installed must either be owned by the applicant or have the owner’s consent.

- Electricity Bill History: Must provide an electricity bill record for at least the past 6 months.

- Business Eligibility

- Business Location: Businesses must be registered and active within Punjab.

- Registered Entities: Only registered businesses with a proper license are eligible to apply.

- Electricity Bill Record: A minimum of 12 months’ electricity bill history is required for businesses.

Financial Assistance and Loan Details

The Punjab government has designed the loan terms to be cheap and accessible, with grants available on interest rates. Here’s what applicants need to know about the fiscal assistance:

- Loan Amount

- Maximum loan amount is PKR 500,000for cover installations.

- Business entities may qualify for higher amounts based on project size.

- Loan Term and Interest Rate

- Loans are offered for up to 5 yearswith low-interest rates, thanks to government subsidies.

- Interest rates are about 3% to 5%, making it affordable for households and small businesses.

- Repayment Options

- Monthly installments are flexible, allowing customers to repay as per their suitability.

- Early repayment options are available without any price.

Required Documents for Application

The following documents are mandatory for all applicants:

National Identity Card (CNIC): A copy of the CNIC for identity verification.

Property Ownership Documents: Proof of property ownership or permission from the property owner.

Electricity Bill Record: For housing applicants, 6 months of bills; for businesses, 12 months.

Income Proof: Bank statement or income tax return as proof of income.

Business Registration(for businesses only): Valid registration document.

More Read:CM Punjab Solar Panel Scheme

Step-by-Step Application Process

Applying for the Punjab Solar Panel Financing Scheme is simple. Here’s how you can do it:

- Visit the Official Portal

- Go to the Punjab Energy Department’s official website and locate the solar financing scheme section.

- Complete the Online Application Form

- Fill in personal and contact details, upload perused copies of required documents, and submit the application.

- Document Verification

- Once submitted, the application will go through a proof process to confirm eligibility.

- Loan Approval and Disbursement

- Upon confirmation, eligible applicants will receive loan approval within a few weeks. Funds are disbursed directly to the approved solar installation provider.

Recommended Solar Panel Providers

Here are some recommended solar panel providers official by the Punjab government:

More Read:JS Bank Solar Financing

Pak Solar Power Company

Solar Solutions Pvt Ltd

Future Energy Solutions

Green Energy Pakistan

How to Check Your Application Status

After applying, you can track your application status by logging into your account on the Punjab Energy Department’s website. Use your application number and CNIC for quick updates.

FAQs

Can tenants apply for the scheme?

Yes, but they need written consent from the property owner.

Are there any penalties for early repayment?

No, there are no penalties for early repayment.

How long does it take for the loan to be approved?

Typically, approvals take between 2 to 4 weeks, depending on the verification process.

Conclusion

The Punjab Solar Panel Backing Scheme is an excellent chance for households and businesses in Punjab to switch to renewable energy without the burden of high upfront costs. With low-interest loans, this scheme not only makes solar energy cheap but also contributes to a workable environment.