Ehsaas Loan Program 2024

The Ehsaas Loan Scheme is a important creativity by the Government of Pakistan aimed at empowering deprived communities through interest-free financial assistance. Designed to alleviate lack and foster economic growth, the program offers financial aid to persons looking to establish or expand small businesses. This scheme ensures that worthy Pakistanis can access capital without the burden of interest. With the 2024 updates, the program has introduced new features and efficient its application process to make it more nearby.

More Read:Punjab Honhaar Scholarship Program 2024

Quick Information Table

| Program Name | Ehsaas Loan Program 2024 |

| Start Date | January 1, 2024 |

| End Date | December 31, 2024 |

| Amount of Assistance | PKR 20,000 to PKR 500,000 |

| Interest | Completely Interest-Free |

| Eligibility | Low-income individuals and small business owners |

| Method of Application | Online and Offline |

| Official Website | https://www.pass.gov.pk |

What Is the Ehsaas Loan Program?

The Ehsaas Loan Scheme is part of the broader Ehsaas initiative, launched by the Government of Pakistan to reduce poverty and provide social safety nets for weak segments of society. It is exactly tailored for individuals seeking to improve their livelihoods through small-scale businesses. The program offers:

More Read:BOP Himmat Card New Registration

- Interest-Free Loans: Enabling applicants to focus on business growth without worrying about repayment burdens.

- Empowerment of Women: A important portion of the loans is reserved for women to promote gender equality in free enterprise.

- Nationwide Accessibility: Available in rural and urban areas through chosen centers and online platforms.

Key Features of the 2024 Ehsaas Loan Program

1. Increased Loan Limit

For 2024, the loan amount has been increased to a maximum of PKR 500,000, ensuring sufficient capital for larger business activities.

2. Simplified Application Process

The application system has been digitized, allowing folks to apply online through the official Ehsaas website or by visiting nearby help centers.

3. Priority for Women and Youth

In line with the government’s focus on authorizing youth and women, a important portion of the funds is allocated to female financiers and young persons.

More Read:Khud Kafalat Scheme

4. Partnership with Microfinance Institutions (MFIs)

The program collaborates with prominent MFIs and NGOs to ensure seamless loan payment and clear operations.

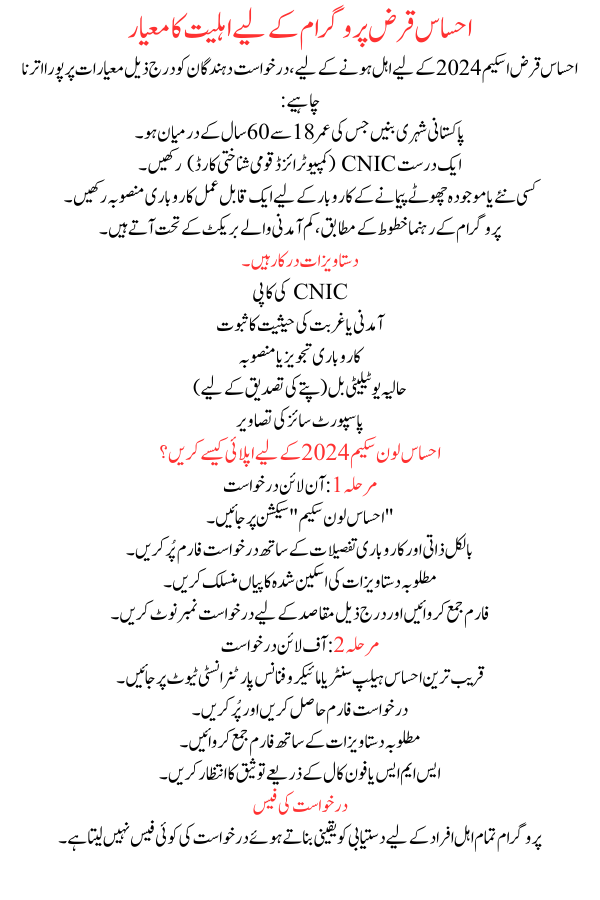

Eligibility Criteria for the Ehsaas Loan Program

To qualify for the Ehsaas Loan Scheme 2024, applicants must meet the following criteria:

- Be a Pakistani citizen aged between 18 and 60 years.

- Possess a valid CNIC (Computerized National Identity Card).

- Have a viable business plan for a new or current small-scale enterprise.

- Fall under the low-income bracket, as defined by the program’s guidelines.

Documents Required

- Copy of CNIC

- Proof of income or poverty status

- Business proposal or plan

- Recent utility bill (for address verification)

- Passport-sized photographs

How to Apply for the Ehsaas Loan Scheme 2024?

Step 1: Online Application

- Visit the official Ehsaas program website: https://www.pass.gov.pk.

- Navigate to the “Ehsaas Loan Scheme” section.

- Fill out the application form with exact personal and business details.

- Attach scanned copies of required documents.

- Submit the form and note down the application number for following purposes.

More Read:Resolve Fingerprint Issues in BISP

Step 2: Offline Application

- Visit the nearest Ehsaas help center or microfinance partner institute.

- Obtain and fill out the application form.

- Submit the form along with required documents.

- Wait for validation via SMS or a phone call.

Application Fee

The program does not charge any application fee, ensuring availability for all eligible individuals.

Loan Disbursement Process

Once the application is approved:

- Applicants will receive a confirmation message with details of the loan amount.

- The disbursement is made directly to the applicant’s bank account or via partner institutes.

- The repayment schedule will be provided, tailored to the business’s earning capacity.

More Read:Prime Minister’s Kamyab Jawan Scheme

Benefits of the Ehsaas Loan Program

- Financial Inclusion: Helps low-income groups contribute in economic activities.

- No Interest Burden: Promotes entrepreneurship without adding financial stress.

- Job Creation: Enables small businesses to expand, generating employment chances.

- Support for Vulnerable Groups: Focuses on women, youth, and marginalized publics.

Challenges and Improvements

Challenges

- Limited awareness in rural areas.

- Delayed approvals in some regions.

Improvements in 2024

- Enhanced outreach through digital campaigns.

- Faster approval devices to expedite the process.

FAQs about the Ehsaas Loan Program

Is there any interest on the loan amount?

No, the program is completely interest-free.

How long does the application process take?

Typically, it takes 2-4 weeks for approval, depending on the application volume.

Can women apply for loans under this Scheme?

Yes, women are strongly encouraged to apply, with dedicated funds allocated for them.

More Read:mobilink bank salary loan

Are there any penalties for late repayment?

The program promotes flexible repayment schedules to accommodate applicants’ conditions.

Conclusion

The Ehsaas Loan Scheme 2024 is a transformative step towards building a self-reliant Pakistan. By offering interest-free financial support, the program empowers persons to attain their business dreams and donate to the country’s economic development. Whether you’re a budding entrepreneur or a small business owner, this creativity is a golden chance to secure funding without fiscal strain.