Khud Kafalat Scheme

The Khud Kafalat Program, launched under the banner of the Benazir Income Support Program (BISP), is a important step by the Government of Pakistan to promote autonomy among women. This scheme empowers women by if interest-free loans, enabling them to start small businesses and improve their socioeconomic conditions. It is part of a broader plan to lessen poverty and enhance financial inclusion, especially for demoted sections of society.

More Read:BISP 13500 Payment Phase 2

Below is a table summarizing key details of the Khud Kafalat Program for quick reference:

| Program Name | Khud Kafalat Scheme |

| Start Date | [Insert updated date here] |

| End Date | Ongoing (No specific deadline yet announced) |

| Assistance Amount | Up to PKR 75,000 (Interest-Free Loan) |

| Eligibility Criteria | Women from low-income families |

| Method of Application | Both Online and Offline |

What is the Khud Kafalat Scheme?

The Khud Kafalat Program is part of Pakistan’s financial authorization creativities targeted at underprivileged women. By providing access to interest-free loans, the program aims to uplift the economic status of women in Pakistan. Women are encouraged to establish micro-enterprises, thus donating to the country’s economic growth while attaining personal financial stability.

The Program operates through the Pakistan Poverty Improvement Fund (PPAF) in collaboration with microfinance institutions. The creativity specifically targets rural and urban women who have limited access to traditional banking systems and financial resources.

More Read:Punjab Green Tractors Scheme

Objectives of the Khud Kafalat Scheme

The scheme is designed to achieve the following goals:

- Promote Women’s Empowerment: Empower women by giving them access to financial resources and executive power.

- Poverty Reduction: Provide low-income households with a means to improve their living standards.

- Encourage Entrepreneurship: Support small businesses and foster self-employment among women.

- Financial Inclusion: Integrate demoted women into the financial network by offering them loans through formal institutes.

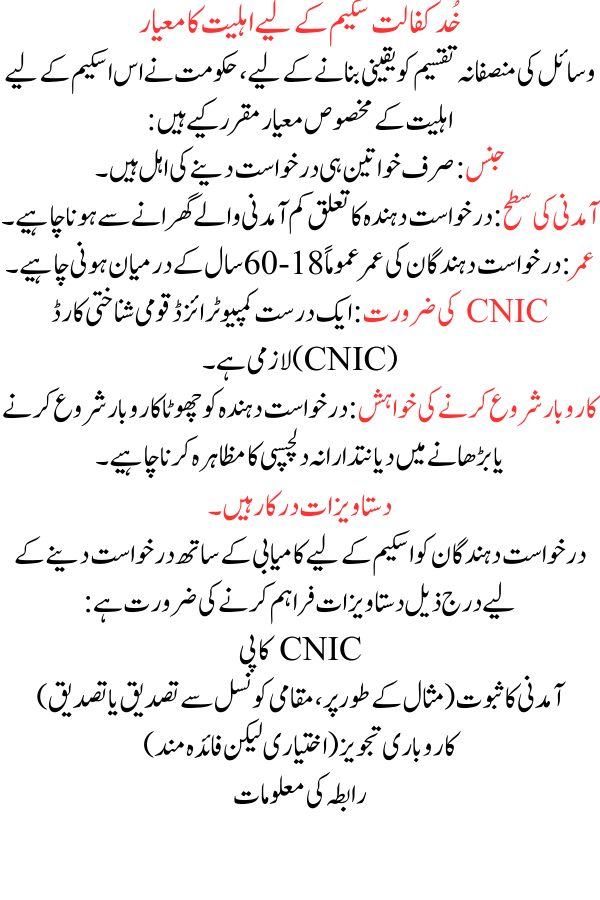

Eligibility Criteria for the Khud Kafalat Scheme

To ensure fair distribution of resources, the government has set specific eligibility criteria for this scheme:

- Gender: Only women are eligible to apply.

- Income Level: The applicant must belong to a low-income household.

- Age: Applicants should generally be between 18-60 years old.

- CNIC Requirement: A valid Computerized National Identity Card (CNIC) is mandatory.

- Willingness to Start a Business: The applicant must demonstrate a honest interest in starting or growing a small business.

Loan Amount and Benefits

The scheme provides interest-free loans of up to PKR 75,000, with the give to use the funds for various business activities such as:

More Read:Benazir Taleemi Wazaif Stipend

- Opening a grocery store

- Founding a tailoring or embroidery business

- Running a small-scale livestock or poultry farm

- Setting up other micro-enterprises based on local market demands

Repayment Terms

The repayment schedule is simple and flexible, ensuring minimal financial pressure on the beneficiaries. The goal is to promote sustainability, not burden the recipients with unmanageable debt.

How to Apply for the Khud Kafalat Scheme

Women interested in availing of this scheme can apply through the following methods:

- Online Application

The government has introduced a digital platform to simplify the application process. Women can visit the official BISP or PPAF website to fill out the application form, upload required documents, and track their application status.

More Read:35000 Free laptops for Matric and Intermediate Position Holder Students

- Offline Application

For women without internet access, applications can be succumbed through designated BISP offices or microfinance institutions. Field officers also assist in outreach efforts to ensure eligible women in distant areas are not left out.

Documents Required

Applicants need to provide the following documents to successfully apply for the scheme:

- CNIC Copy

- Proof of Income (e.g., confirmation or verification from a local council)

- Business Proposal (optional but beneficial)

- Contact Information

Impact of the Khud Kafalat Scheme on Society

The Khud Kafalat Program is making a profound difference in Pakistan’s social and economic fabric. Some of its notable impacts include:

More Read:Benazir Taleemi Wazaif Stipend Program

- Economic Upliftment: Women have launched thousands of successful businesses, ranging from couture shops to agricultural ventures.

- Improved Living Standards: Families supported by the scheme report improved access to education, healthcare, and diet.

- Reduction in Gender Inequality: By giving women financial self-rule, the scheme is narrowing the gender gap in economic contribution.

- Community Development: Local communities benefit as women-led businesses thrive, contributing to job formation and regional development.

Challenges Faced by the Khud Kafalat Scheme

Despite its success, the scheme faces certain challenges:

- Awareness Gap: Many eligible women in rural areas remain unaware of the program.

- Cultural Barriers: In conformist areas, women may face resistance from their families or communities when following financial individuality.

- Limited Infrastructure: A lack of internet access and banking services in remote areas complicates the application process.

Government’s Response to Challenges

To address these issues, the government is conducting awareness drives and collaborating with local NGOs to ensure the scheme reaches the most vulnerable women.

More Read:Punjab Roshan Gharana Scheme

Conclusion

The Khud Kafalat Program is a transformative initiative aimed at empowering women across Pakistan. By providing interest-free loans, the program is creating chances for financial individuality, reducing poverty, and development sustainable economic growth. For women hopeful to build a better future for themselves and their families, this scheme offers a solid basis to attain their goals.