How to Apply for a Ubank Salary Loan in Pakistan?

In the Pakistan, where management moneys on a incomplete salary can be stimulating, especially for medical and paid specialists facing unforeseen expenses, U Microfinance Bank Limited provided an reachable solution. With the Ubank Salary Loan, salaried people from various sectors—govt, semi-govt, and private—can contact up to PKR 350,000 to meet their crucial economic needs. This loan capability adheres to Shariah-compliant principles, confirming it aligns with Islamic economics values, and is planned for swift dispensation, helping persons quickly address economic challenges.

In this article, we’ll provide a inclusive director on the Ubank Salary Loan, explanation its features, eligibility requirements, certification, and application process, so you can make an conversant excellent.

What is the Ubank Salary Loan?

U Microfinance Bank Limited provider a loan program tailored for salaried workers in Pakistan, especially those who need direct economic help beyond their monthly income. This program helps workers in crises, such as medical bills, education costs, or unexpected family desires, by providing loan amounts up to PKR 350,000. Ubank aims to support Pakistan’s workforce with a loan facility that is reasonable, Shariah-compliant, and inclusive, featuring choices for repayment that extend up to 60 months.

Key Features of the Ubank Salary Loan

To give you a clear image, here are the main features of the Ubank Salary Loan:

Loan Limit: Up to PKR 350,000, offering elastic loan amounts based on your monthly income.

Eligibility: Open to govt, semi-govt, and private sector employees.

Loan Tenure: Repayment terms are elastic, up to 60 months, which allows for more controllable monthly payments.

Equal Installments: Repayment is planned into secure monthly installments, helping borrowers plan their finances.

Insurance Coverage: Fixed life and health cover provide economic security to the borrower and family.

By contribution these features, Ubank makes it easier for salaried workers to handle urgent costs while still management monthly repayments within their cheap.

Benefits of Ubank Salary Loan for Salaried Employees

The Ubank Salary Loan is planned exactly for people who need quick access to funds without high-interest charges. Here’s why this loan can be particularly beneficial:

Shariah-Compliant: Ubank’s salary loan program follows Islamic finance principles, making it a suitable option for those who prefer non-interest-based financial products.

Affordable Repayment Plans: With fixed monthly installments over a period of up to 60 months, borrowers can manage their budgets more effectively.

Insurance Benefits: Fixed life and health cover reduce the risk burden on the borrower, offering peace of mind for the family.

Quick and Simple Application: Ubank has streamlined the process, so salaried employees can easily get a loan without excessive paperwork or long wait times.

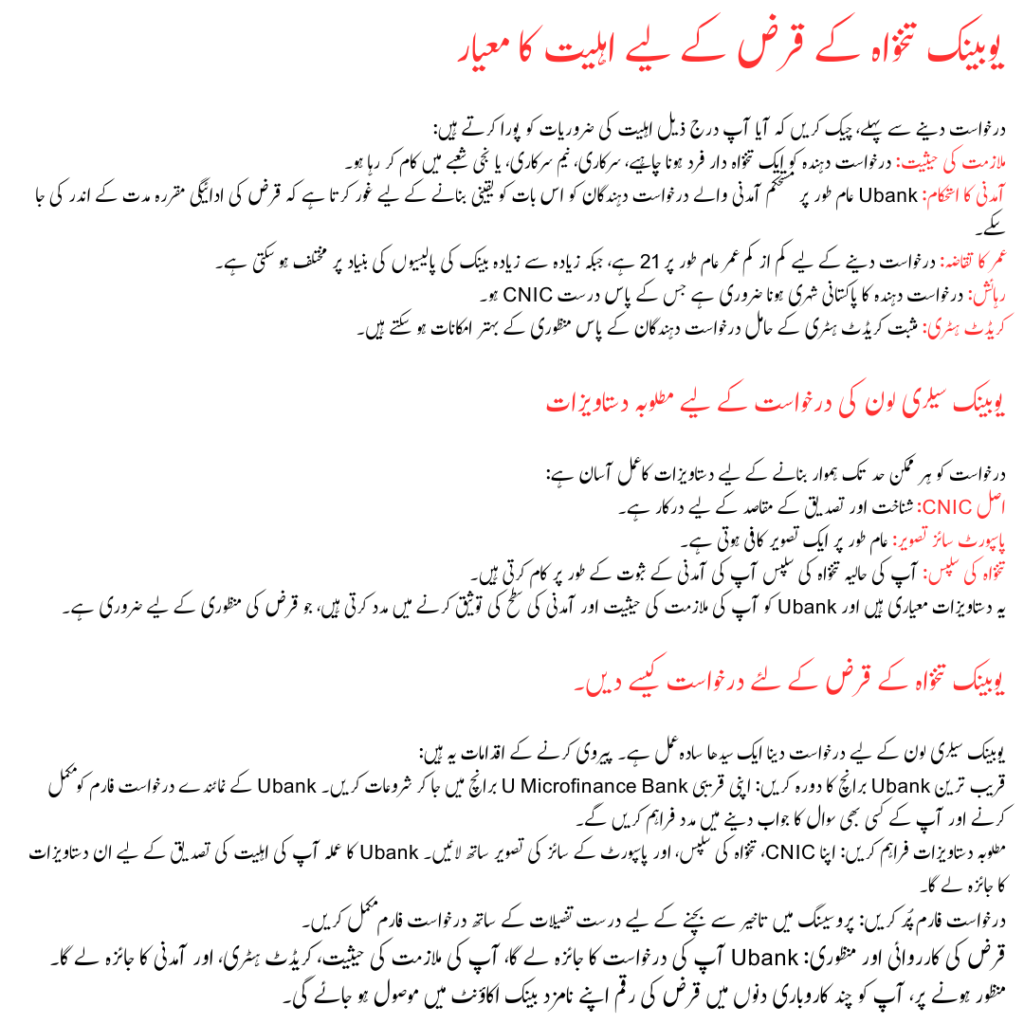

Eligibility Criteria for Ubank Salary Loan

Before applying, check if you meet the following eligibility requirements:

Employment Status: The applicant must be a salaried individual, working in either the government, semi-government, or private sector.

Income Stability: Ubank generally considers candidates with a steady income to confirm that the loan can be repaid within the chosen period.

Age Requirement: The minimum age to apply is typically 21, while the maximum may vary based on the bank’s policies.

Residency: The candidate must be a Pakistani citizen with a valid CNIC.

Credit History: Applicants with a positive credit history may have better chances of approval.

Required Documents for Ubank Salary Loan Application

The documentation process is simple to make the application as seamless as possible:

Original CNIC: Required for identification and verification purposes.

Passport Size Photograph: Usually one photo is sufficient.

Salary Slips: Your most current salary slips act as proof of your income.

These documents are typical and help Ubank verify your service status and income level, which is essential for loan approval.

How to Apply for a Ubank Salary Loan

Applying for the Ubank Salary Loan is a frank process. Here are the steps to follow:

Visit the Nearest Ubank Branch: Start by staying your nearest U Microfinance Bank branch. Ubank’s governments will provide assistance in completing the application form and answering any questions you might have.

Provide Required Documents: Bring along your CNIC, salary slips, and a passport-sized photo. Ubank staff will review these credentials to verify your eligibility.

Fill Out the Application Form: Complete the application form with correct specifics to avoid delays in processing.

Loan Processing and Approval: Ubank will assess your application, studying your service status, credit history, and income. If approved, you’ll accept the loan amount in your designated bank account within a few business days.

FAQs

Here are some frequently asked questions to address any other queries you might have:

Who is eligible to apply for the Ubank Salary Loan?

Salaried employees from the govt, semi-govt, and private sectors are eligible to apply.

What is the maximum loan amount I can apply for?

The maximum loan amount available through the Ubank Salary Loan is PKR 350,000.

Is the Ubank Salary Loan interest-free?

Yes, the loan is planned to be Shariah-compliant, following Islamic economics principles.

How long does it take for loan approval?

Typically, approval takes a few business days after submitting all needed documents and completing the application.

What repayment options does Ubank offer?

Ubank offers up to 60 months for repayment, with equal monthly payments.

Are there any additional fees associated with the loan?

It’s recommended to confirm with Ubank for any related processing or administrative fees, though they aim to keep fees minimal.

Does Ubank offer insurance coverage with this loan?

Yes, Ubank provides embedded credit life and health cover for loan applicants.

What happens if I miss a monthly installment?

Contact Ubank directly to discuss options. Missing payments may result in penalties and impact your credit record.

Can I apply for the loan online?

At present, candidates need to visit the nearest Ubank branch to complete the application process.

Where can I get more information on the Ubank Salary Loan?

For more details, you can visit Ubank’s certified website or contact their customer service number for direct assistance.

Final Thoughts

The Ubank Salary Loan is a practical solution for salaried employees facing imperative financial needs. With a maximum loan limit of PKR 350,000, elastic repayment terms, and built-in cover coverage, Ubank offers a dependable economic support option that complies with Islamic principles and banking law. This loan can meaningfully help workers manage unplanned expenses and calm their finances without burdening them with high-interest fees.

For any further info, you can contact Ubank at their certified customer support number or visit a branch near you to discuss your loan choices with their governments.