khyber bank loan scheme for government employees

As a government worker in the Pakistan, you may sometimes want extra economic support for emergencies, education, weddings, or other important costs. The Bank of Khyber Salary Loan scheme, also known as the BOK Salary Sahara Loan, is planned exactly for govt and semi-govt workers. It offers cheap terms, reasonable interest-rates, and Islamic finance agreement to confirm that borrowers accept fair and convenient contact to loans.

In this article, we’ll provide complete information on the Khyber Bank Loan Scheme for Govt Employees 2025, including the Bank of Khyber salary loan interest rate, eligibility requirements, features, and the application process.

Also Read : Punjab Roshan Gharana Scheme 2024: A Comprehensive Guide

Overview

The Bank of Khyber Loan Scheme for Govt Employees 2025 provided a unique solution for salaried person by providing fast and available financing to cover various personal desires. With this loan, govt and semi-govt employees can borrow an amount equal to 15 times their net take-home salary, up to a max of PKR 2 million. This funding can be paid in easy monthly installments over a dated of up to 4-years.

JS Bank’s Salary Sahara Loan Provided comprehensive features that cater to salaried persons looking for an reasonable, convenient financing choice without needless financial burdens. Plus, being an Islamic-compliant loan choice, BOK provided loans without interest (Sood), making it more reachable to borrowers with religious thoughts.

Features of BOK Salary Sahara Loan

The khyber bank loan scheme provides multiple features that kind it an good-looking option for salaried people. Below are the main features:

- Loan Amount: Up to 15 times net take-home salary, with a cap of PKR 2 million.

- Loan Tenure: Elastic tenure with repayment periods of up to 4 years.

- Life Insurance: Compulsory life assurance covering the loan amount.

- Balance Transfer Facility: Allows borrowers to transfer an current loan balance from another bank.

- Top-Up Facility: Eligible borrowers can avail a top-up facility after 1 year.

- Early Settlement Option: Partial and full changes are allowed at any time.

These features make the Bank of Khyber Salary Loan an ideal choice for govt employees requiring reliable funding without the pressure of immediate repayment.

Also Read : Himmat Card Payment Phase 2: Complete Guide

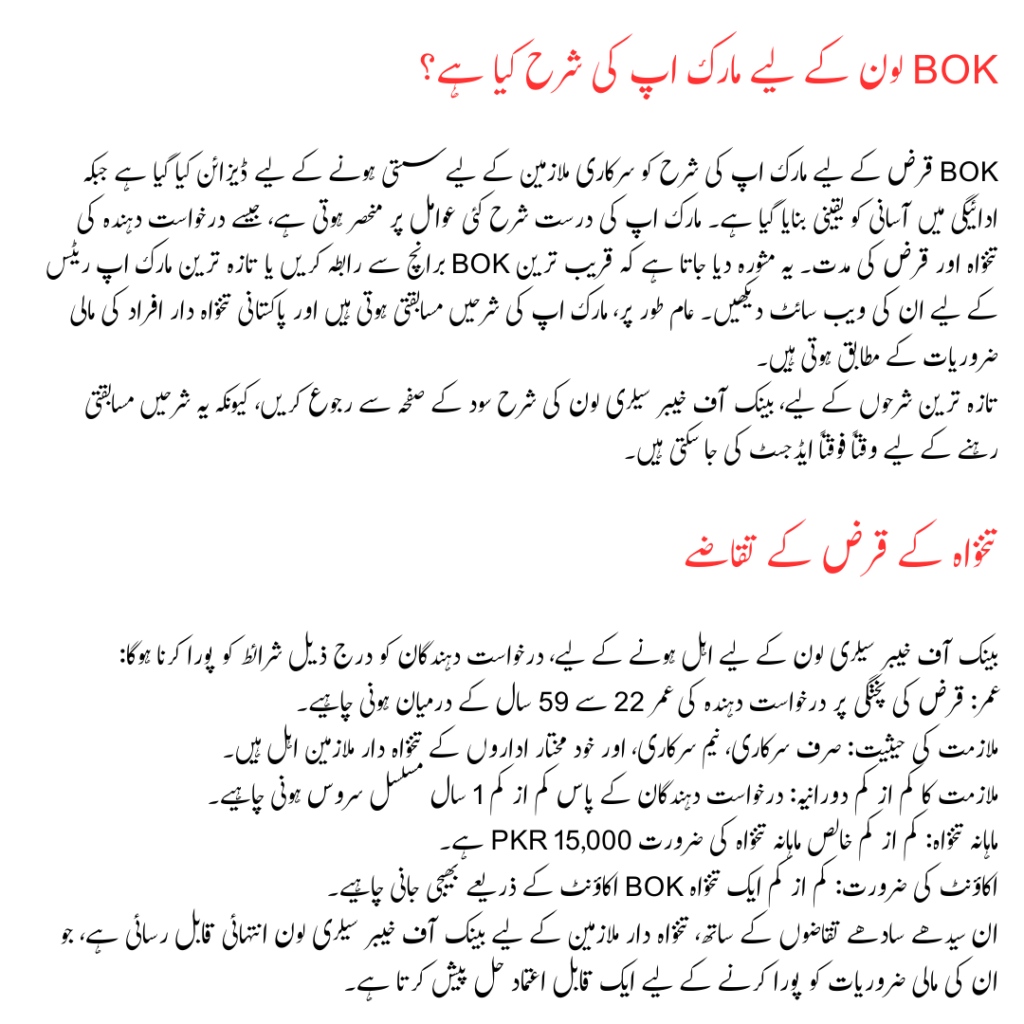

What is the Markup Rate for BOK Loan?

The khyber bank loan scheme is planned to be reasonable for govt employees while confirming ease of repayment. The exact markup rate varies dependent on several factors, such as the applicant’s salary and the tenancy of the loan. It’s advised to contact the nearest BOK branch or visit their website for the most updated markup rates. Generally, the markup rates are competitive and allied with the financial needs of Pakistani salaried persons.

For the most present rates, consult the Bank of Khyber Salary Loan Interest Rate page, as these rates may be sometimes adjusted to remain competitive.

Salary Loan Requirements

To qualify for a Bank of Khyber Salary Loan, candidates must meet the following requirements:

Age: Candidate must be between 22 to 59 years at loan maturity.

Employment Status: Only salaried person from govt, semi-govt, and autonomous bodies are eligible.

Minimum Employment Duration: Candidates must have at least 1 year of continuous service.

Monthly Salary: Minimum net monthly salary requirement is PKR 15,000.

Account Requirement: At least one salary must be routed through a BOK account.

With these frank requirements, the Bank of Khyber Salary Loan is highly reachable for salaried people, offering a reliable solution to manage their financial needs.

Also Read : Kisan Card 30% Cash Withdrawal

Bank of Khyber Salary Loan Calculator

For those seeing this loan, the Bank of Khyber salary loan calculator provides a suitable way to estimate monthly installments based on your loan amount and repayment tenure. Using this tool, potential borrowers can better plan their funds and decide on an reasonable loan amount.

To calculate your monthly installments, follow these steps:

- Visit the BOK Loan Calculator: BOK Loan Calculator.

- Enter Loan Details: Input the desired loan amount and tenure.

- View Monthly Installment: Check the estimated EMI based on the selected loan details.

This calculator helps you plan your cheap by showing how much you’ll need to repay each month.

How to Apply

Applying for the khyber bank loan scheme is simple and can be done online or at a BOK branch. Here’s how to get started:

- Online Application: Visit the official BOK website for customer eligibility and loan application. Enter your details, submit, and BOK will contact you within 2-3 business days for further processing.

- Form Download: After online submission, download the application form from BOK’s website, print it, fill it out, and submit it at the nearest BOK branch.

- Document Submission: Visit your nearest branch with required documents, such as CNIC, recent salary slips, and employment verification.

The BOK team will guide you through each step, making the loan process effective and easy to complete.

Frequently Asked Questions

1, What is the maximum amount I can borrow with BOK Salary Sahara Loan?

You can borrow up to PKR 2 million.

- What is the Bank of Khyber loan scheme for government employees in 2024?

This scheme offers salaried govt employees loans up to 15 times their net monthly salary.

- What is the markup rate for BOK loan?

The markup rate depends on your salary and loan tenure. Check the latest rates by contacting BOK.

- Can I transfer my loan balance from another bank to BOK?

Yes, BOK offers a balance transfer facility for existing loans from other banks.

- Is there a pre-mature adjustment facility in the BOK Salary Loan?

Yes, BOK allows partial and pre-mature adjustments on this loan.

- What documents are required for applying?

You’ll need your CNIC, recent salary slips, and employment verification letter.

- How long does it take for the loan application process?

After form submission, the bank will contact you within 2-3 days, with further processing at your nearest branch.

- Is life insurance mandatory with this loan?

Yes, life insurance covering the loan amount is required.

- How can I calculate my monthly installment?

Use the BOK Salary Loan Calculator available on their website.

- Where can I apply for the Bank of Khyber Salary Loan?

Apply online or visit any BOK branch. Check the official website for more details.

Conclusion

The khyber bank loan scheme is a reliable financing option for govt employees in Pakistan who need quick access to funds. With elastic terms, competitive markup rates, and Islamic finance obedience, it is an excellent solution for covering various personal expenses. If you need more information, feel free to contact the Bank of Khyber right or visit your nearest branch for assistance.