Interest Free Ehsaas Loan Program

The Ehsaas Program Loan Interest Free is an creativity by the Govt of Pakistan aimed at present financial aid to persons who need financial support. This program is part of the broader Ehsaas creativity, which has presented various welfare programs for relegated sections of society. The loan program offers interest-free loans, providing a significant chance for low-income people to start or grow their businesses without the burden of attention payments.

In this article, we will explore all the important facts of the Ehsaas Loan Program , with how to apply, eligibility criteria, required documents, and the steps to check your suitability online.

Ehsaas Loan Program

The Ehsaas Loan Program is planned to uplift the economically disadvantaged by providing interest-free loans. These loans’ purpose to help out small businesses grow and sustain themselves, ultimately reducing deficiency and unemployment in Pakistan. The program is available to a broad range of Pakistanis, with individuals from low-income families, women, and young entrepreneurs.

By providing interest-free loans, the Ehsaas Loan Program safeguards that people can utilize the funds for various business ventures without the stress of repayment with added interest. This makes it an good-looking option for many who wish to follow their business dreams but are held back by financial constraints.

Ehsaas Loan Program Online Registration

To avail of the aids of the Ehsaas Loan Program , applicants are obligatory to register online. The online registration procedure is simple, user-friendly, and can be done through the official Ehsaas portal.

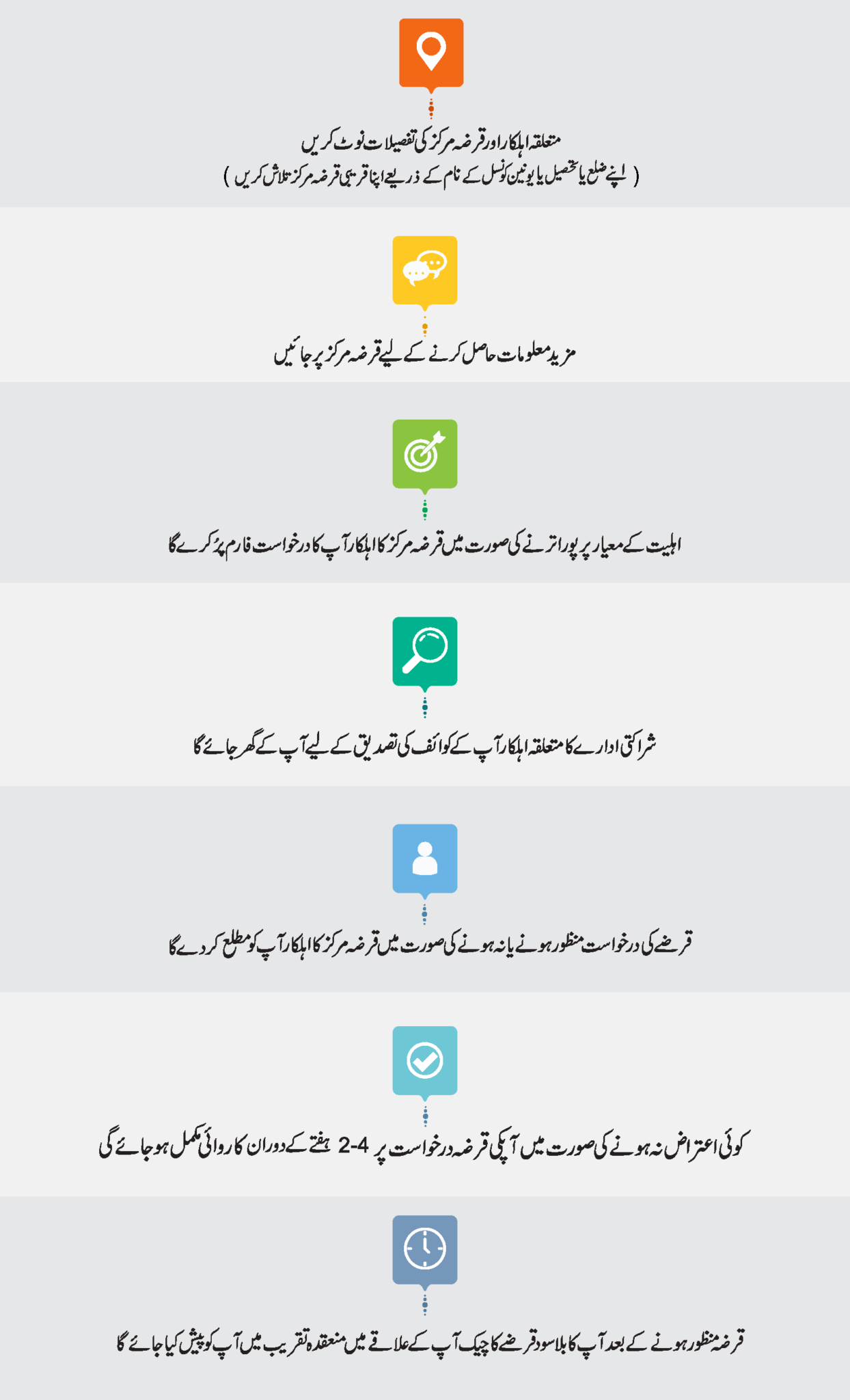

The steps for registration online are outlined below:

- Visit the Official Ehsaas Portal: You can start by visiting the official Ehsaas website. The website is planned to provide clear instructions to attendant applicants through the entire registration process.

- Create an Account: If you don’t already have an account, you’ll need to create one by providing basic info such as your name, contact details, and CNIC (Computerized National Identity Card) number.

- Complete the Registration Form: After making your account, fill out the registration form with correct information. This contains personal details, business information (if applicable), and contact details.

- Submit Your Application: Once the form is filled out, review your details and submit your application. You will receive a approval email or SMS representative that your application has been received.

Ehsaas Loan Program Eligibility

The eligibility criteria for the Ehsaas Loan Program are frank but must be carefully reviewed before applying. The program is planned to assist the most financially helpless individuals, but not everyone is automatically eligible.

Key Eligibility Criteria:

Pakistani Citizen: Applicants must be Pakistani citizens with a valid CNIC.

Age: The applicant should be between the ages of 18 and 60 years.

Income Level: Only persons from low-income households are eligible. There is a cap on monthly income, which may vary by area.

Business Plan: Applicants must have a clear business plan or validate a need for the loan to sustain their existing small business.

These are the essential eligibility factors that determine whether you qualify for the Ehsaas Loan Program.

How to Check Eligibility Criteria Online?

Checking your eligibility for the Ehsaas Loan Program online is a suitable process. You can visit the Ehsaas program’s official website or use their mobile application for eligibility verification.

Steps to check eligibility online:

- Visit the Ehsaas Loan Portal: Head to the official website and log in using your CNIC and password.

- Eligibility Checker: Navigate to the section that says “Eligibility Checker.”

- Enter Required Information: You will need to input basic details such as your CNIC, age, income, and business plan.

- Get Results: After entering the details, the system will let you know whether or not you are qualified for the interest-free loan program.

This step is crucial as it helps you avoid needless delays in the application process.

Ehsaas Program Loan Online Apply

To apply for the Ehsaas Program Loan, follow these easy steps:

- Log in to the Ehsaas Loan Portal: After confirmative your eligibility, log in to the portal with your registered account.

- Fill Out the Application Form: Provide all required personal and business-related info accurately.

- Upload Documents: You will need to upload the required documents, such as a copy of your CNIC, income documentation, and proof of your business plan (if applicable).

- Submit Application: Double-check your application and submit it. You will receive a confirmation message once your application is successfully submitted.

The online application process is transparent and efficient, confirming that your loan application is processed swiftly.

Required Documents

To complete your loan application, sure documents are obligatory. These include:

- CNIC (Computerized National Identity Card): A clear copy of your CNIC is essential.

- Proof of Income: This may include salary slips or other documents verifying your revenue level.

- Business Plan: If you are applying for a loan to start or enlarge a business, a full business plan is required.

- Bank Account Details: You may need to provide your bank account details where the loan amount can be transferred.

- Proof of Residency: Utility bills or other documents that prove your residency can also be required.

These documents confirm that the application process is legitimate and that funds are fixed to those who qualify.

Application Last Date

The last date to apply for the Ehsaas Program Loan in is yet to be announced officially. Applicants are advised to often check the official Ehsaas website or their nearest Ehsaas center for updates. Missing the deadline could mean waiting another year for this opportunity.

Make sure to apply well before the limit to avoid any last-minute issues.

Where to Visit for More Information?

If you need more facts or face problems during the application process, you can visit the Ehsaas Centers located across Pakistan. The staff there can guide you through the entire process and address any queries you might have.

Additionally, the official Ehsaas helpline can be contacted at +92 (51) 8439450-79 for assistance. If you’re unable to find the contact number, visiting the official website is a reliable option.

FAQs

- What is the Ehsaas Loan Program ?

A: The Ehsaas Loan Program is a government initiative offering interest-free loans to low-income individuals, helping them start or expand small businesses. The program aims to reduce poverty and empower marginalized communities by providing financial support without interest. - Who is eligible for the Ehsaas Loan Program ?

A: Pakistani citizens between the ages of 18 and 60 from low-income households are eligible. Applicants must have a valid CNIC, demonstrate financial need, and either have a business plan or an existing small business requiring funding. - How can I apply for the Ehsaas Loan Program online?

A: To apply online, visit the official Ehsaas website, create an account, fill out the application form with your details, and upload the required documents. Once submitted, you will receive a confirmation message. - What documents are required for the Ehsaas Loan application?

A: The required documents include:

- CNIC (Computerized National Identity Card)

- Proof of income

- A detailed business plan (if applicable)

- Bank account details

- Proof of residency (utility bills, etc.)

- How do I check my eligibility for the Ehsaas Loan Program?

A: You can check your eligibility by visiting the Ehsaas Loan Portal and using the “Eligibility Checker.” Enter your CNIC, age, income details, and business information to find out if you qualify for the loan. - Is there any interest on the loans provided through the Ehsaas Program?

A: No, the loans provided under the Ehsaas Loan Program are completely interest-free. This means that you only repay the principal amount borrowed, without any additional charges. - What is the maximum loan amount I can get under the Ehsaas Program?

A: The maximum loan amount varies based on the applicant’s need and the business plan. Generally, the loans range from PKR 20,000 to PKR 75,000, depending on the individual’s financial situation and business requirements. - When is the last date to apply for the Ehsaas Loan Program ?

A: The last date for applying to the Ehsaas Loan Program has not been officially announced yet. It’s important to stay updated by checking the official Ehsaas website or visiting the nearest Ehsaas center for the latest information. - Can I apply for the Ehsaas Loan without a business plan?

A: Yes, you can apply even without a formal business plan if you’re seeking the loan for small-scale income-generating activities. However, having a business plan increases your chances of approval and may result in a larger loan amount. - Where can I get help if I face problems during the application process?

A: If you encounter any issues while applying, you can visit your nearest Ehsaas Center for assistance. You can also contact the official Ehsaas helpline at [Contact Number Placeholder], or visit the Ehsaas website for more information.

Conclusion

The Ehsaas Program Loan Interest Free is an exceptional opportunity for those in need of financial support to start or grow their small businesses. By offering interest-free loans, the government is empowering individuals and reducing economic inequality. The online application process, easy eligibility criteria, and accessible registration make it easier for Pakistanis to benefit from this program.