Ehsaas Nojawan Program

The Khyber Pakhtunkhwa (KPK) Government has formally launched the Ehsaas Nojawan Program, a transformative creativity aimed at allowing young Pakistanis. This program provides interest-free and collateral-free loans to help the youth found businesses, creating employment chances across the province. The program is a key component of the broader Ehsaas program, which focuses on poverty easing and social welfare.

This article will guide you through all the essential details, confirming you have complete knowledge of the program and its benefits.

Also Read : Cost of Solar Panels in Pakistan: Complete Guide (2024)

| Program Name | Ehsaas Nojawan Program |

| Start Date | November 2024 |

| End Date | Ongoing |

| Amount of Assistance | Up to PKR 500,000 |

| Application Method | Online |

Ehsaas Nojawan Program

The Ehsaas Nojawan Program is a youth-focused initiative designed to address idleness and rouse economic growth. It offers interest-free loans reaching from PKR 50,000 to PKR 500,000, enabling young moguls to establish or expand their businesses. The program’s emphasis on small-scale initiatives makes it accessible to a wide range of applicants, mainly those from underprivileged backgrounds.

The initiative underscores the KPK Government’s commitment to reducing youth unemployment and development self-reliance among Pakistanis.

More Read:

Loan Distribution Details

Under the Ehsaas Nojawan Program, the loans are distributed through a transparent mechanism to ensure just access. The key features include:

- Loan Range: PKR 50,000 to PKR 500,000

- Target Group: Youth aged 18–45

- Repayment Period: Flexible terms ranging from 1 to 5 years

- Focus Areas: Startups, small businesses, and agriculture-based ventures

The program also offers training and mentorship to loan recipients, ensuring they have the necessary skills to manage and grow their businesses efficiently.

Also Read : Prime Minister Youth Business Loan: A Comprehensive Guide

Interest-Free and Collateral-Free Loans

A standout feature of the Ehsaas Nojawan Program is that the loans are both interest-free and collateral-free. This removes important barriers for young businesspersons who may lack assets or face financial constraints.

Benefits of Interest-Free Loans:

- No financial burden of additional repayment costs

- Encourages wider input among carefully poor youth

Why Collateral-Free Matters:

- Ensures inclusivity for applicants who lack property or assets

- Builds confidence in aspiring moguls

These features align with the program’s goal of empowering the youth without adding financial stress.

Also Read : CM Maryam Launches Shrimp Farming Internship Program for Youth

How to Apply for Ehsaas Nojawan Program Loans

Step-by-Step Application Guide:

- Visit the Official Portal: Applicants need to access the Ehsaas Nojawan Program’s online portal, ensuring their device is connected to the internet.

- Create an Account: Provide your CNIC, phone number, and other basic details to register.

- Fill Out the Application Form: Complete the form with accurate information about your business idea, education, and financial needs.

- Upload Documents: Attach scanned copies of your CNIC, educational certificates, and a business plan (if applicable).

- Submit the Application: Review all information carefully before submission.

- Confirmation Message: After successful submission, a confirmation message will be sent to your registered phone number.

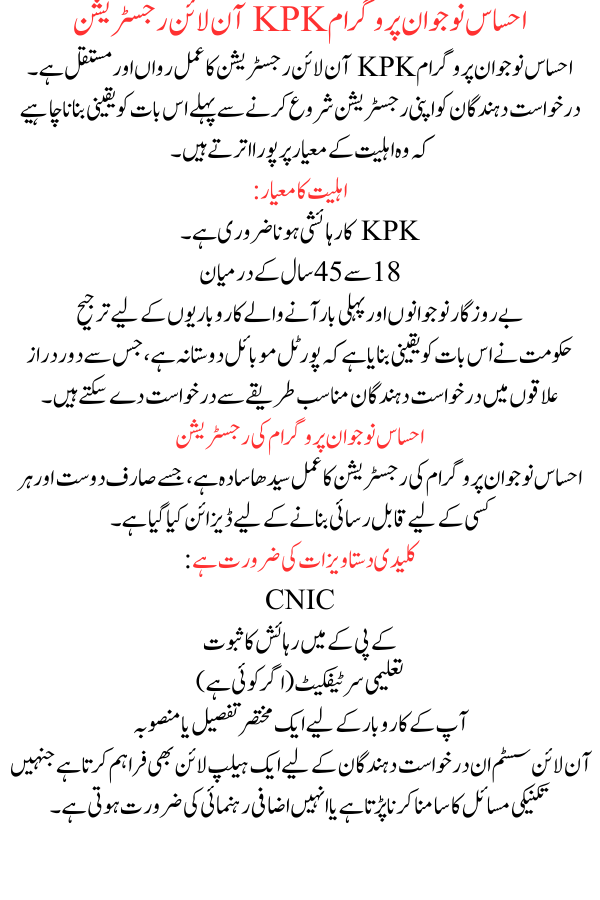

Ehsaas Nojawan Program Registration

The Ehsaas Nojawan Program Registration process is straightforward, designed to be user-friendly and accessible to everyone.

More Read:

Key Documents Required:

- CNIC

- Proof of residence in KPK

- Educational certificates (if any)

- A brief description or plan for your business

The online system also provides a helpline for applicants who face technical problems or need extra guidance.

Ehsaas Nojawan Program KPK Online Registration

The Ehsaas Nojawan Program KPK Online Registration process is live and constant. Applicants must ensure they meet the eligibility criteria before starting their registration.

Eligibility Criteria:

- Must be a resident of KPK

- Aged between 18 and 45 years

- Preference for unemployed youth and first-time entrepreneurs

The government has ensured that the portal is mobile-friendly, allowing applicants in remote areas to apply suitably.

Also Read : Sukoon Salary Loan: A Comprehensive Guide for Pakistani Citizens

Equitable Allocation Across KPK

To ensure fair distribution, the program allocates loans across KPK districts uniformly. Priority is given to underdeveloped regions, ensuring that youth from rural and less-privileged areas benefit equally.

Highlights of Equitable Allocation:

- Special focus on tribal districts and remote areas

- Balanced distribution to prevent regional disparities

This approach helps achieve the program’s broader goal of reducing income inequality and development economic growth in demoted communities.

Impact of the Ehsaas Nojawan Program

The Ehsaas Nojawan Program is expected to have a important impact on the socio-economic fabric of KPK:

- Reduction in Youth Unemployment: Thousands of young Pakistanis will gain access to self-employment opportunities.

- Economic Growth: By encouraging free enterprise, the program will stimulate local economies.

- Empowerment of Women: A substantial number of loans are reserved for female entrepreneurs, promoting gender equality.

- Skill Development: Training sessions and workshops will enhance receivers’ business acumen and business skills.

More Read:

Conclusion

The Ehsaas Nojawan Program is a game-changer for the youth of KPK, offering them the financial support and resources needed to build a prosperous future. With its interest-free and collateral-free loans, equitable distribution, and focus on empowering sidelined groups, this invention is poised to make a lasting impact.