Allied Bank Loan for Government Employees

Government and private workers in Pakistan frequently face unexpected economic desires for events like weddings, medical care, education and urgent payments. To address these desires, Allied Bank Provided a loan product called Allied Personal Finance Loan.

Is this article we will complete guide you on how Allied Bank loans work, eligibility requirements, loan calculator usage, and How you can apply for this loan which are helping you make informed financial decisions.

Also Read : How to Apply for the ACAG Program

What is Allied Personal Finance Loan?

Allied Personal Finance loan provides a elastic loan choice with easy repayment terms, catering especially to salaried and self-employed peoples across Pakistan. It offers loan amounts from Rs. 30,000 to Rs. 3,000,000 with a repayment time duration of 1 to 4 years. Whether you’re looking to recover your home, cover wedding expenditures, and as will as pursue an educational goal, Allied Personal Finance can help you reach these dreams.

This product is particularly helpful for government employees due to its suitable repayment structure and elastic loan amounts. With cheap markup rates, no hidden responsibilities, and prepayment options, Allied Personal Finance Provided peace of mind and financial safety to its customers.

Key Features and Benefits

- Flexible Repayment Period: Choose a repayment term from 1 to 4 years, depending on what suits you best.

- Loan Amount Range: From Rs. 30,000 to Rs. 3,000,000, allowing you to select a loan amount that fits your needs.

- Low Markup Rates: Allied Bank offers a sensible markup rate, keeping loan charges manageable.

- Simple Documentation: No complex paperwork—just straightforward documentation requirements.

- No Hidden Fees: All charges are clear, so there are no surprises.

- Prepayment Facility: Options for partial or full payment if you wish to settle your loan early.

- Additional Financing Option: If desired, you can request a economics enhancement to top up your loan.

Allied Bank Personal Finance is presently accessible in several main cities, counting Lahore, Karachi, Islamabad/Rawalpindi, Faisalabad, Multan, Sialkot, Gujranwala, and Hyderabad.

Also Read : Sindh Government Solar System Initiative – Registration

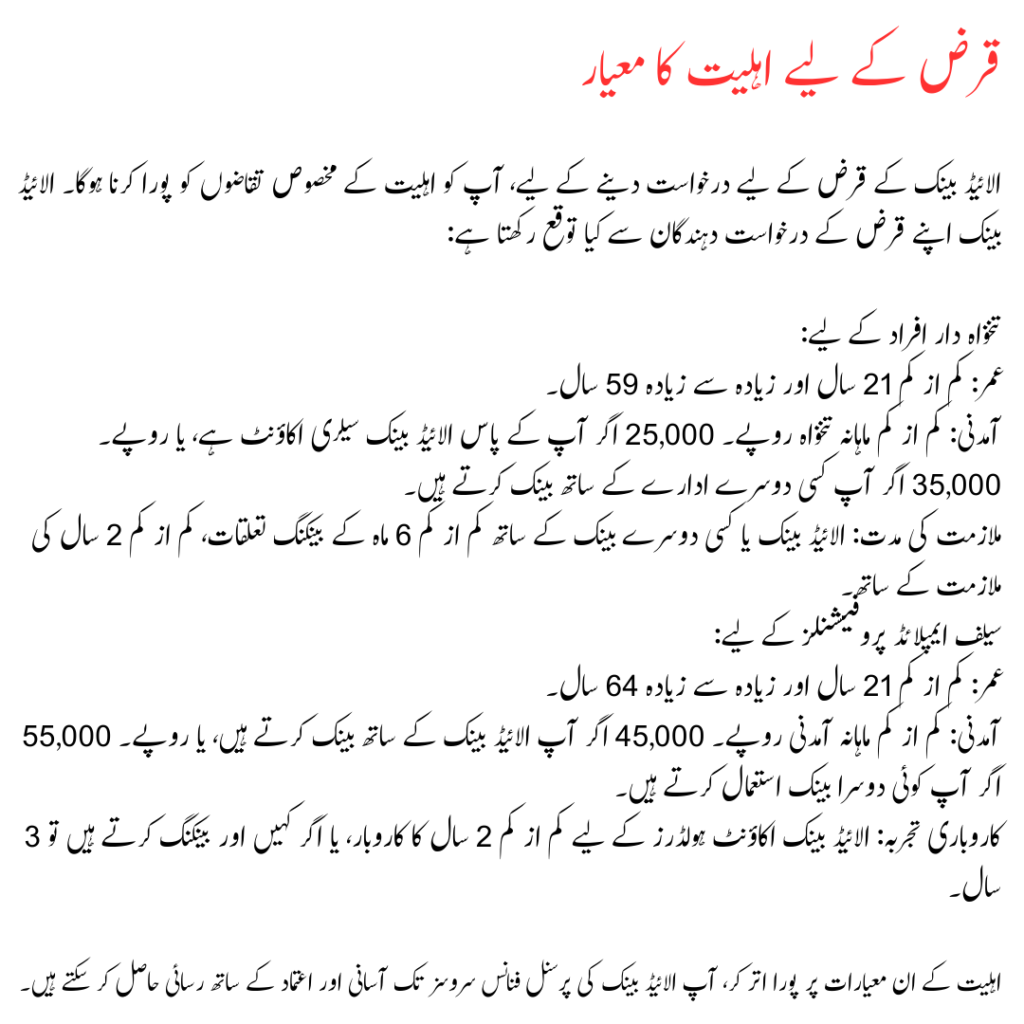

Eligibility Criteria for Loan

To apply for an Allied Bank loan, you need to meet detailed suitability requirements. Here’s what Allied Bank expects from its loan applicants:

For Salaried Individuals:

- Age: Minimum of 21 years and maximum of 59 years.

- Income: Minimum monthly salary of Rs. 25,000 if you hold an Allied Bank salary account, or Rs. 35,000 if you bank with another organization.

- Employment Tenure: At least 6 months of banking connection with Allied Bank or any other bank, with a minimum of 2 years of employment.

For Self-Employed Professionals:

- Age: Minimum 21 years and maximum 64 years.

- Income: Minimum monthly income of Rs. 45,000 if you bank with Allied Bank, or Rs. 55,000 if you use another bank.

- Business Experience: Minimum 2 years of business for Allied Bank account holders, or 3 years if banking elsewhere.

By meeting these eligibility criteria, you can access Allied Bank’s Personal Finance services with ease and confidence.

Salary Loan Calculator

The Allied Bank loan calculator is a helpful tool that lets you evaluation your monthly repayments based on the loan amount and tenure you choose. This calculator helps you understand the financial impact of your loan and plan your budget accordingly. To use the calculator, visit the Allied Personal Finance calculator and input your wanted loan amount, tenancy, and interest rate.

This tool gives you a pure view of your monthly repayment and total interest owed, helping you make an informed decision.

Also Read : Chief Minister Punjab Maryam Nawaz Sharif launched Zindagi Asan Program

How to Apply

Applying for an Allied Bank loan is a frank process. Here’s how you can get started:

Visit the Nearest Allied Bank Branch: Gather your required documents and visit any Allied Bank branch near you.

Submit Documentation: Complete the application form and acquiesce your required documents, including CNIC, income proof as well as address verification.

Approval Process: Once submitted, Allied Bank reviews your application, and if all is in order, your loan will be approved prompt.

For more full information, feel free to contact Allied Bank’s client service.

FAQs

What is the minimum loan amount I can apply for with Allied Personal Finance?

The minimum loan amount is Rs. 30,000, which is ideal for lesser financial needs.

Can government employees apply for this loan?

Yes, government employees are eligible for Allied Bank’s personal loan, providing they meet the required criteria.

How do I calculate my monthly repayment?

You can use the Allied Bank loan calculator to calculate your monthly payments by incoming the loan amount, term, and interest rate.

What are the markup rates for Allied Bank loans?

The markup rate starts at 1YK+10% and goes up to 1YK+18% based on your loan amount and tenure.

Is there a prepayment option?

Yes, Allied Bank proposals a prepayment facility for both partial and full payment of the loan.

Are there any hidden charges associated with the loan?

Allied Bank has no extra charges, safeguarding a clear and fair loan process.

How long does it take to process my loan application?

The dispensation time depends on your certification completeness and suitability but is typically summary for complete applications.

What happens if I miss a monthly installment?

Missing an installment may result in late fees or consequences, so it’s significant to budget for opportune repayments.

Is Allied Personal Finance available outside major cities?

Presently, Allied Personal Finance is obtainable in major cities like Lahore, Karachi, Islamabad, Rawalpindi, Faisalabad, Multan, Sialkot, Gujranwala, and Hyderabad.

How can I contact Allied Bank for more information?

You can reach Allied Bank’s customer service finished their information or by visiting any of their branches.

Conclusion

Allied Bank’s loan for government workers is a valued option for salaried people looking to manage financial crises. With features like low markup rates, supple repayment terms, and simple documentation, this loan produce makes it easy for employees to meet numerous needs, from medical expenses to weddings or education.

For more information, feel free to visit your nearest Allied Bank branch or contact their customer service.