Faysal Bank Car Loan Apply Online in Pakistan

Faysal Bank Car Loan Apply Online in Pakistan Owning a car is a goal for many Pakistanis, especially among the middle-class and medical professionals. Whether you’re a salaried person or self-employed, financing options like the Faysal Bank car loan scheme make it easier for you to own a car without straining your budget.

In this article, we’ll explore how you can apply for a Faysal Bank car loan online, learn about the Faysal Bank car installment plan 2024, and use their car loan calculator to estimate your payments. Our aim is to give you all the necessary information, so you can confidently take the next step toward your new vehicle.

Overview of Faysal Bank Car Loan Scheme

Faysal Bank offers a flexible and Shariah-compliant car financing solution under Diminishing Musharakah. This method allows you to gradually buy out the bank’s share in your car while paying rent on the part you don’t own yet. The bank makes it easy to finance both new and used cars with up to 70% of the car’s value covered under the scheme.

The best part? You can apply for the Faysal Bank car loan online, making the entire process convenient and hassle-free.

Key Features:

- Financing available for new and used vehicles.

- Tenure up to 5 years for vehicles under 1000cc, and up to 3 years for vehicles above 1000cc.

- No processing fee until financing approval.

- Easy online application process.

- Takaful insurance from reputable companies for protection.

- Flexible down payments and installment options.

Whether you’re a salaried individual, business person, or self-employed, Faysal Bank has an option that can be tailored to meet your needs.

Faysal Bank Car Installment Plan 2024

The Faysal Bank car installment plan 2024 is designed to make car ownership easy and affordable. Depending on the car’s engine size and your financial capability, you can choose a tenure that best suits you.

| Car Type | Maximum Tenure |

|---|---|

| Vehicles up to 1000cc | Up to 5 years |

| Vehicles above 1000cc | Up to 3 years |

The Faysal Bank car installment plan also includes the option of early settlement and partial pre-payment, giving you more control over your loan. This flexibility ensures you can repay the loan comfortably without unnecessary financial stress.

Additionally, for customers with property rental income, Faysal Bank can consider it as part of your total income, allowing for a higher financing amount.

Faysal Bank Car Loan Apply Online

Wondering how to apply for a Faysal Bank car loan online? It’s a simple process that can be completed from the comfort of your home. Here’s a step-by-step guide:

- Visit the Faysal Bank Website: Go to the Faysal Bank official website and navigate to the Car Finance Application Page.

- Fill Out the Application: Enter your personal information, car details, and financial information.

- Upload Documents: Submit required documents such as your CNIC, salary slips, and bank statements.

- Submit the Form: Once the form is filled and documents uploaded, submit your application.

- Approval: After submission, the bank will process your application, and upon approval, you’ll be able to proceed with the car purchase.

By applying online, you save time and can track your loan’s progress easily.

Faysal Bank Car Loan Calculator

It’s important to estimate your monthly payments before committing to a loan. The Faysal Bank car loan calculator allows you to enter details like the car price, down payment, and loan tenure to get an accurate estimate of your monthly installments. This tool helps you budget better and ensures you’re not overextending yourself financially.

To use the calculator, click here.

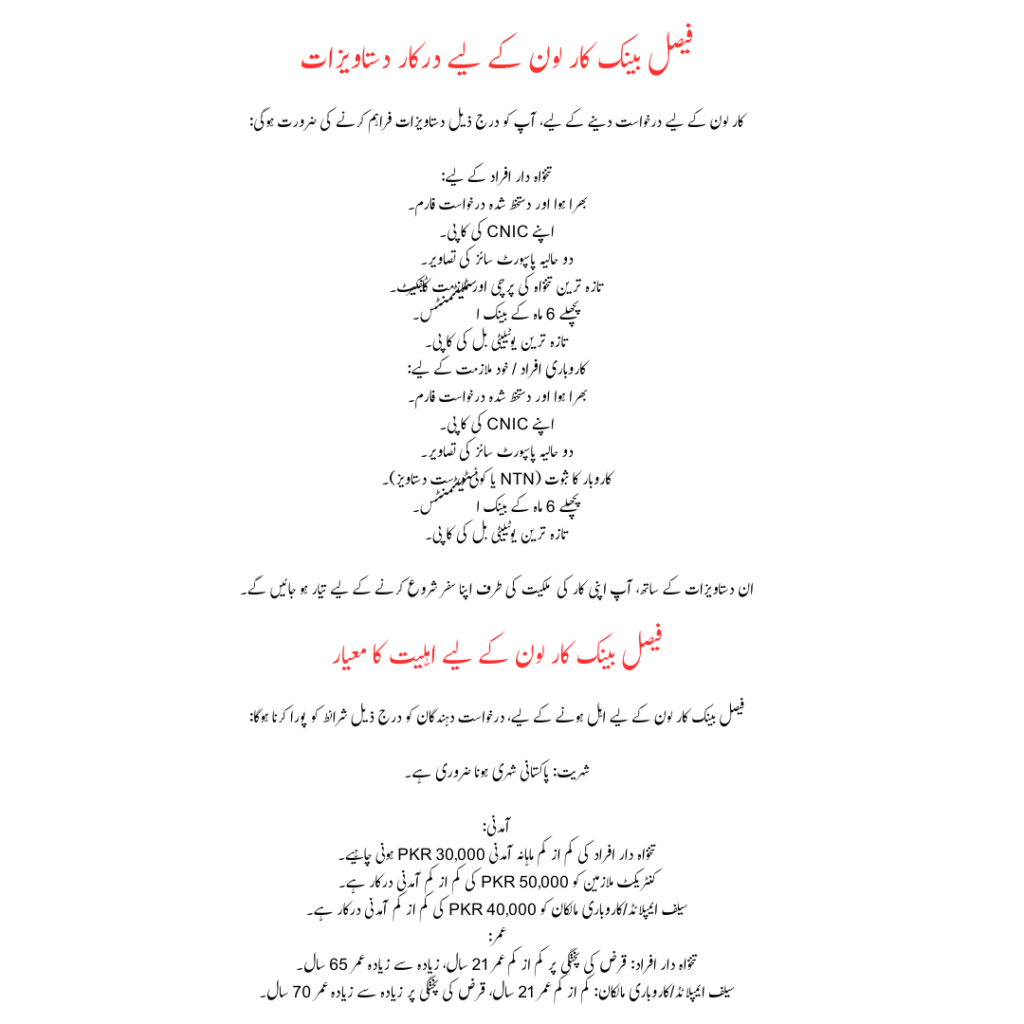

Documents Required for Faysal Bank Car Loan

To apply for a car loan, you will need to provide the following documents:

For Salaried Individuals:

- Filled and signed application form.

- Copy of your CNIC.

- Two recent passport-sized photographs.

- Latest salary slip and employment certificate.

- Last 6 months’ bank statements.

- Copy of latest utility bill.

For Businesspersons/Self-Employed:

- Filled and signed application form.

- Copy of your CNIC.

- Two recent passport-sized photographs.

- Proof of business (NTN or any valid document).

- Last 6 months’ bank statements.

- Copy of latest utility bill.

With these documents, you’ll be ready to start your journey toward owning your car.

Eligibility Criteria for Faysal Bank Car Loan

To be eligible for the Faysal Bank car loan, applicants must meet the following requirements:

Citizenship: Must be a Pakistani national.

Income:

- Salaried individuals must have a minimum monthly income of PKR 30,000.

- Contractual employees need a minimum income of PKR 50,000.

- Self-employed/business owners need a minimum income of PKR 40,000.

Age:

- Salaried individuals: Minimum age 21 years, maximum age 65 years at loan maturity.

- Self-employed/business owners: Minimum age 21 years, maximum age 70 years at loan maturity.

These criteria make it easier for a wider range of people to access the financing they need.

Faysal Bank Residual Value Financing

For customers who want a more affordable installment option, Faysal Bank offers Residual Value Financing. This scheme allows you to pay lower monthly installments, as you agree to pay a lump sum at the end of the financing period.

Residual Value Grid:

| Tenure | Maximum Residual Value % Allowed |

|---|---|

| 1 year | Maximum 50% |

| 2 years | Maximum 40% |

| 3 years | Maximum 35% |

| 4 years | Maximum 30% |

| 5 years | Maximum 25% |

This scheme is available for select local vehicles, including Suzuki, Honda, Indus, KIA, and Master brands. It gives you more flexibility to finance a higher-value car with lower monthly payments.

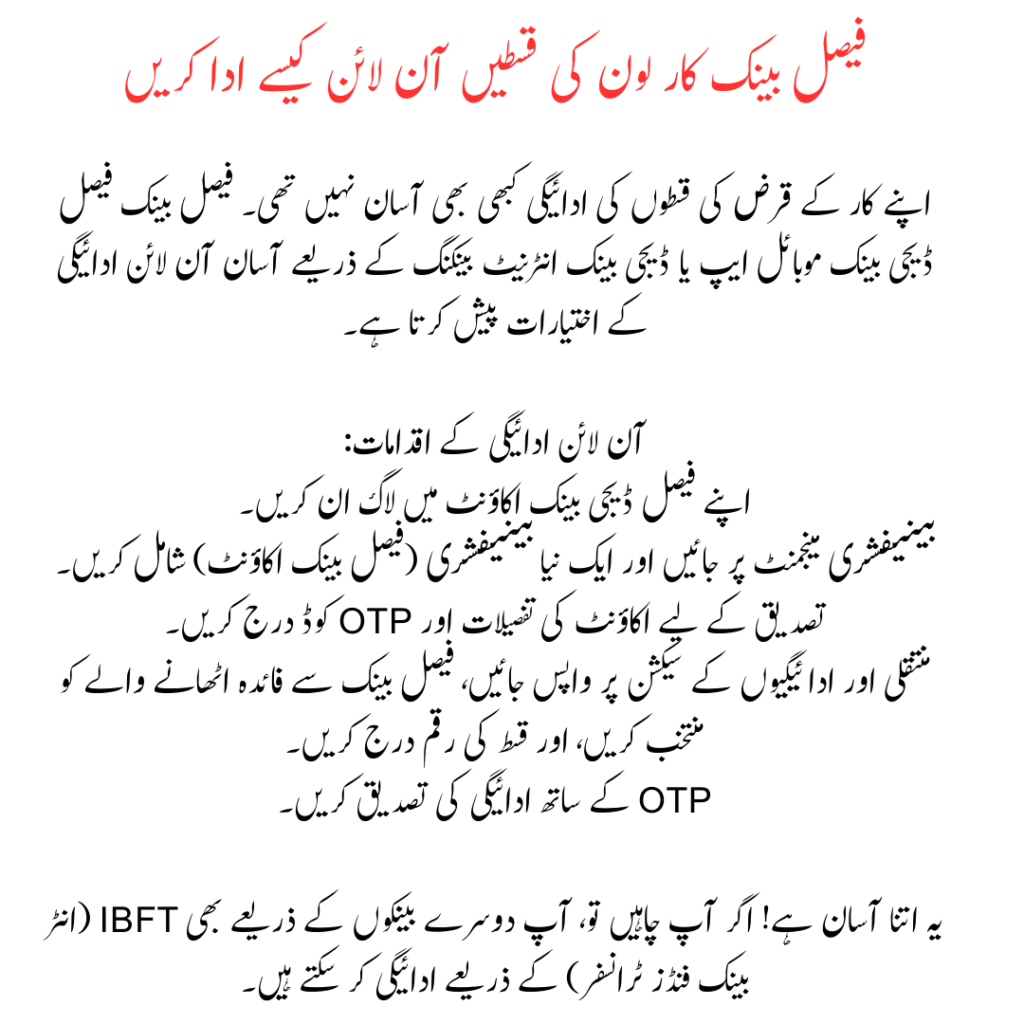

How to Pay Faysal Bank Car Loan Installments Online

Paying your car loan installments has never been easier. Faysal Bank offers convenient online payment options through Faysal Digibank Mobile App or Digibank Internet Banking.

Steps for Online Payment:

- Log in to your Faysal Digibank account.

- Go to Beneficiary Management and add a new beneficiary (Faysal Bank account).

- Enter account details and OTP code for verification.

- Return to the Transfer and Payments section, select the Faysal Bank beneficiary, and enter the installment amount.

- Confirm the payment with the OTP.

It’s that simple! If you prefer, you can also pay through other banks via IBFT (Inter Bank Funds Transfer).

FAQs

1. How do I apply for a Faysal Bank car loan online?

Visit the official website and complete the online application form.

2.What is the maximum tenure for a car loan?

Up to 5 years for vehicles under 1000cc, and up to 3 years for vehicles above 1000cc.

3.How does the Faysal Bank car installment plan work?

You can choose from flexible financing tenures and installment options based on your vehicle type and financial situation.

4.What is Residual Value Financing?

It allows you to pay lower monthly installments by agreeing to pay a larger amount at the end of the financing period.

5.What documents are required for salaried individuals?

CNIC, salary slip, bank statements, employment certificate, and utility bill.

6.Is there a processing fee for the Faysal Bank Car Loan Apply Online in Pakistan ?

No processing fee is charged until your financing is approved.

7.Does Faysal Bank offer Islamic car financing?

Yes, the bank offers car financing based on the principles of Diminishing Musharakah.

8.How can I calculate my car loan installments?

Use the Faysal Bank car loan calculator to estimate your payments.

9.Can I make partial prepayments on my loan?

Yes, partial pre-payment options are available.

10. Is takaful coverage included?

Yes, Takaful coverage is provided from reputable companies on Faysal Bank’s panel.

Conclusion

Faysal Bank Car Loan Apply Online in Pakistan provides an accessible way for middle-class families to own their dream car. Whether you prefer conventional or Shariah-compliant financing, the bank offers flexible repayment options, easy online applications, and hassle-free processing. Apply today and start driving your dream car with confidence!

For more information, visit Faysal Bank’s official car finance page.