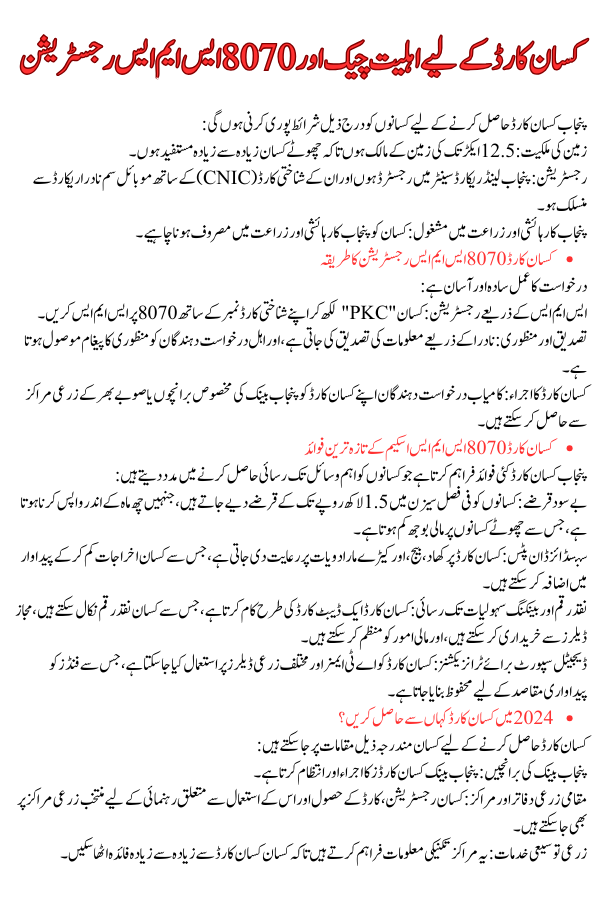

Kisan Card 8070 SMS Registration

The Punjab Kisan Card Loan Scheme 2024, launched by the Punjab government, is intended to provide financial support to small farmers in the province. Under this program, farmers can admission interest-free loans and backed agricultural inputs to enhance their productivity and economic constancy. The scheme, announced by Chief Minister Maryam Nawaz Sharif, aims to permit around 500,000 farmers across Punjab by offering financial aid to buy essential capital like seeds, fertilizers, and pesticides.

Read More Info:How Sindh Bank Solar Financing Can Lower

Quick Information Table

| Field | Details |

| Program Name | Punjab Kisan Card Loan Scheme |

| Start Date for Application | June 1, 2024 |

| Last Date for Application | Ongoing |

| Bank Involved | Bank of Punjab |

| Loan Amount | Up to Rs. 1.5 lakh per crop season |

| Repayment Period | Six months |

| Applicable Regions | All districts of Punjab |

| Application Method | SMS registration via 8070 or through local agricultural centers |

Eligibility Check for Kisan Card 8070 SMS Registration

To qualify for the Punjab Kisan Card, farmers must:

- Own land up to 12.5 acres, confirming that small-scale farmers benefit the most.

- Be registered with the Punjab Land Record Center and have a CNIC-registered mobile SIM linked with NADRA records.

- I am a resident of Punjab and am currently involved in agricultural activities.

Read More Info: Bank Alfalah Islamic Home Loan:

Kisan Card 8070 SMS Registration Procedure

The application process is simple and accessible:

- Registration by SMS: Farmers should type “PKC” followed by their CNIC number and send it to 8070.

- Verification and Confirmation: The information is verified by NADRA, and eligible applicants receive an approval message.

- Kisan Card Issuance: Successful applicants can collect their Kisan Card at designated Bank of Punjab branches or agricultural centers across the province.

Latest Benefits of the Kisan Card 8070 SMS Scheme

The Punjab Kisan Card offers multiple benefits, helping farmers access critical resources:

- Interest-Free Loans: Farmers can receive loans of up to Rs. 1.5 lakh per crop season, repayable within six months, easing the financial burden on smallholders.

- Subsidized Inputs: The card discounts fertilizers, seeds, and pesticides, helping farmers reduce input costs and improve yields.

- Access to Cash and Banking Services: The Kisan Card functions similarly to a debit card, letting farmers to withdraw cash, make purchases at authorized dealers, and manage their finances.

- Digital Support for Transactions: The card can be used at ATMs and various agricultural input dealers, safeguarding that funds are utilized directly for productive purposes

Read More Info: How the Livestock Asset Cow Program Benefits Women

Where to Get a Kisan Card in 2024?

Farmers can obtain their Kisan Card by visiting:

- Bank of Punjab Branches: The Bank of Punjab is the primary financial organization involved, in issuing and managing the Kisan Cards.

- Local Agriculture Offices and Centers: Farmers can also visit selected agricultural centers for guidance on registration, card collection, and usage.

- Agricultural Extension Services: These centers provide support with technical information, helping farmers make the most of the Kisan Card

Read More Info: Punjab Government Announces on Roshan Gharana Solar Panel Scheme

Conclusion

The Punjab Kisan Card Loan Scheme is a revolutionary initiative that supports Punjab’s small farmers by providing them with essential financial resources and input subsidies. By reducing costs and enabling access to better agricultural inputs, the scheme promises a boost in agricultural productivity and income for Punjab’s farming community. For farmers seeking to enhance their livelihoods and rationalize their farming operations, the Kisan Card is a valuable tool that brings financial aid and economic stability.

Read More Info:Baitul-Mal Punjab Disability Program 2024